-

Both Bitcoin and Ethereum are holding on to gains with the prospect of more after Jerome Powell said last week that he has ‘no intention’ of banning cryptocurrencies.

-

Elsewhere, a bit of fear is in the air. Evergrande continues as a concern but now a spike in oil prices may be creating another wave of fear elsewhere. And stocks continue to turn after the Fed warned of faster-than-expected rate hikes with a possible taper announcement on the horizon, depending on how jobs data goes. NFP is set to release on Friday.

You can tell a lot about sentiment when US markets open for the week. By that time weve already seen opens in Australia, Asia and Europe and US equity futures are usually already pricing something in.

Last week the S&P 500 gapped-up to begin the week, but sellers continued to press as they erased that gain and then some, with the following Tuesday being brutal for bulls. The week before, on September 20th, stocks gapped-down and just continued to sell-off in a brutal Monday session. And the prior week saw stocks open on Monday with a recovery move after Evergrande worries started to get priced-in on the preceding Friday. But, similarly that bid dissipated throughout the week and stocks have now continued on their path of making lower-lows and lower-highs.

S&P 500 FOUR HOUR PRICE CHART: LOWER-LOWS, LOWER-HIGHS

The reason for recounting all of this is to highlight how risks have been building over the past month and it‘s happening at an inopportune time for the Fed. The FOMC had just started to warn of a slight tweak to the pandemic punch bowl that’s kept markets hopped up for the past year-and-a-half.

Evergrande was initially a 500 billion problem that seemed to dissipate as banks continued to say that they were minimal exposed. A month later, the mess is still being sorted and there‘s no evidence that we’ve seen the bottom of the problem. Along the way, the Fed hosted a hawkish meeting at the September FOMC, warning of both a tapering of asset purchases and rate hikes at some point next year.

And that threat of higher rates has hit the rate-sensitive Nasdaq 100, which has seen even more pain than whats showed in the S&P 500 so far.

Today marked a push below the July low in the Nasdaq 100, which erases the remaining gain from Q3 on the index, and it‘s threatening to breach below a bullish channel that’s been holding support for the index since the start of the year.

NASDAQ 100 DAILY PRICE CHART

OIL PRICES SPIKE TO SIX-YEAR-HIGH

Oil prices were in for a ride today, trading above a massive zone of resistance that hasnt been traded through since 2014.

Normally, a signal of this nature would be a positive, brought upon by hopes for rising demand as the world turns another corner in the pandemic. But, alas, this spike has emanated from supply issues and the knock-on effect is that commodity desks heavily levered in oil now may have some margin calls to meet. There were rumors around the market early on Monday that this might be the case, but the selling in equities hasnt materially worsened since. But, this is still something to keep an eye on for the rest of the week.

OIL MONTHLY PRICE CHART

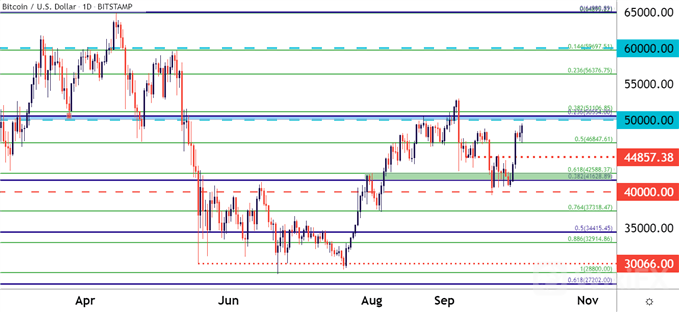

BITCOIN (BTC/USD) AIMING FOR 50K

As risk aversion has heated up, the bid has remained strong in crypto. Just last week, Bitcoin was grinding away at a key support level but this week brings a far different picture.

This likely has more to do with the comments last week from Jerome Powell, when he flat out said he has ‘no intention’ of banning crypto and, instead, shifted the focus towards stablecoins. He even went so far as to ‘re-frame’ prior comments he had made about Central Bank Digital Currencies replacing crypto, saying he had ‘misspoken.’

This was a stunning about-face from the head of the Fed and since those comments dropped last Thursday, both Bitcoin and Ethereum have been well bid since. At this point, Bitcoin appears poised for another breakout run at the 50k psychological level. Beyond that is the current five month high around 53k but if bulls can take that out, there could be some considerable room for the market to run.

BITCOIN (BTC/USD) DAILY PRICE CHART

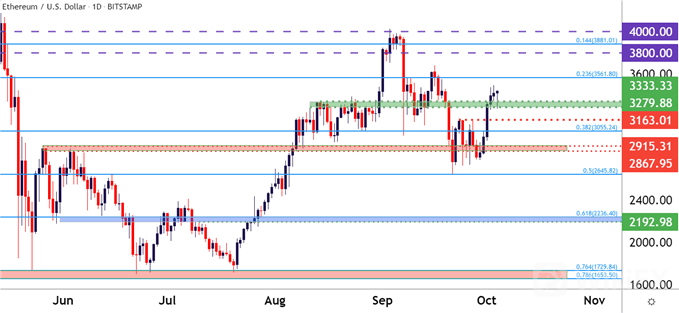

ETHEREUM READYING FOR A RUN?

Ethereum is also holding in a bullish spot and given short-term dynamics, there may be a breakout attempt in the not-too-distant-future here, as well.

Similar to Bitcoin, early last week saw a build of support around a key spot on the chart. The 50% Fibonacci retracement of the Jan 11 – May 12 major move rests at 2,645, and this is the price that caught the low in Ethereum three week ago. Last weeks breakout has held on, and on a short-term basis support has showed up from a prior batch of swing highs, plotted around 3279-3333.

ETHEREUM (ETH/USD) DAILY PRICE CHART

On a shorter-term basis, we can see that support from prior resistance helping to hold the lows today before bulls began to bid it higher. This retains breakout potential as we move deeper into the week.

ETH/USD HOURLY PRICE CHART

Source:DailyFX

Leave a Reply