-

Bitcoin (BTC/USD) prices pull back slightly, inflation expectations rise

-

Ether (ETH/USD) loses traction above the key psychological level of $3,500

-

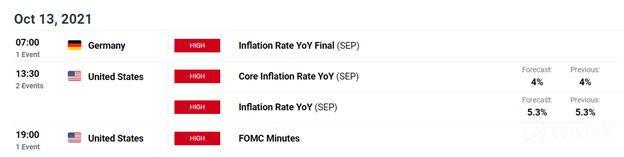

Upcoming FOMC meeting minutes and inflation data weigh on risk sentiment

COULD INFLATION, INTEREST RATES & CHINA THREATEN CRYPTO‘S RECENT RALLY?

Bitcoin, Ether and Cardano have experienced a slight pullback in prices in today’s trading session as investors hone in on inflation expectations and potential reactions from global policymakers.

As major cryptocurrencys continue to face pressure from China, increased geopolitical tensions and the release of high impact economic data (inflation data and the FOMC meeting minutes) may further assist in the catalyzation of price action for the imminent move.

However, with large institutions supporting the recent rally, bullish continuation may still be probable as optimism surrounding the release of a Bitcoin EFT in the foreseeable future continues to grow.

BITCOIN TECHNICAL ANALYSIS

At the time of writing, Bitcoin prices continue to trade above the key psychological level of $55,000 with the 14.4% Fibonacci level of the May – June move providing additional support at $53,672.

As highlighted on the daily chart below, after the formation of a golden cross last month, upward momentum gained traction, allowing bulls to drive prices back above the 50 day moving average.

With the MACD (moving average convergence/divergence) currently trading well-above the zero-line, further institutional support or increased appetite for risk could potentially allow for prices to retest the next big layer of resistance, holding firm at around $59,630 (the May 2021 high)

Bitcoin (BTC/USD) Daily Chart

Meanwhile, Ethereum (ETH) is currently testing the critical level of $3,500 while Cardano (ADA) bulls face a wall of resistance at the $2.00 mark.

Source: DailyFx

Leave a Reply