USD Overview (02 September 2021)

Yesterday, USD weakened against most major currencies except CAD, JPY and CHF.

The ADP Non-Farm Employment Change data (Actual: 374K, Forecast: 620K, Previous: 326K revised from 330K) released yesterday indicated that jobs gained in August fell short of the expectation.

The ISM Manufacturing PMI data (Actual: 59.9, Forecast: 58.5, Previous: 59.5) released yesterday indicated continued expansion of the manufacturing sector in August at a pace similar to July.

FOMC committee member Bostic will be speaking tomorrow at 0100 (GMT+8). FOMC committee member Daly will also be speaking tomorrow at 0300 (GMT+8). During these times, there may be volatility in USD.

NZD/USD Outlook (02 September 2021)

Overall, NZD/USD is ranging across.

Currently, NZD/USD is moving towards the resistance zone of 0.71000 and the next support zone is at 0.69500.

Look for short-term buying opportunities of NZD/USD if it breaks the resistance zone of 0.71000.

AUD/USD Outlook (02 September 2021)

Overall, AUD/USD is ranging across. Recently, AUD/USD broke the resistance zone of 0.73300.

The Australian GDP q/q data (Actual: 0.7%, Forecast: 0.6%, Previous: 1.9% revised from 1.8%) released yesterday indicated a higher than forecasted economic growth during the second quarter.

The Australian Retail Sales m/m data (Forecast: -1.9%, Previous: -2.7%) will be released tomorrow at 0930 (GMT+8).

AUD/USDs next support zone is at 0.73300 and the next resistance zone is at 0.75000.

Look for short-term buying opportunities of AUD/USD.

USD/JPY Outlook (02 September 2021)

Overall, USD/JPY is ranging across. Recently, USD/JPY broke above the key level of 110.

Currently, USD/JPY is testing to break below the key level of 110. Its next support zone is at 108.800 and the next resistance zone is at 110.800.

Look for short-term buying opportunities of USD/JPY if it bounces up from the key level of 110.

EUR/USD Outlook (02 September 2021)

Overall, EUR/USD is ranging across. Recently, EUR/USD bounced up from the key level of 1.18.

The eurozone Unemployment Rate data (Actual: 7.6%, Forecast: 7.6%, Previous: 7.8% revised from 7.7%) released yesterday indicated decline in unemployment in July.

EUR/USDs next support zone is at 1.17600 and the next resistance zone of 1.19000.

Look for short-term buying opportunities of EUR/USD.

GBP/USD Outlook (02 September 2021)

Overall, GBP/USD is trending downwards. Recently, GBP/USD bounced off the resistance zone of 1.38000.

GBP/USDs next support zone is at 1.36000 and the next resistance zone is at 1.38000.

Look for short-term selling opportunities of GBP/USD.

USD/CAD Outlook (02 September 2021)

Overall, USD/CAD is ranging across.

The OPEC+ meeting held yesterday concluded with the decision to hike oil production by 400,000 barrels-per-day for the month of October.

The Canadian Building Permits m/m data (Forecast: 1.5%, Previous: 6.9%) will be released later at 2030 (GMT+8).

Currently, USD/CAD is testing the support zone of 1.26100 and the next resistance zone is at 1.29000.

Look for short-term buying opportunities of USD/CAD if it bounces off the support zone of 1.26100.

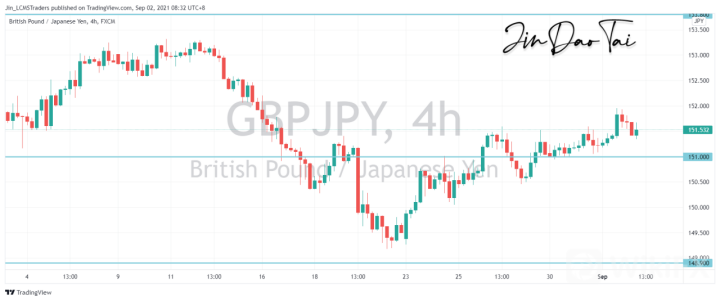

GBP/JPY Outlook (02 September 2021)

Overall, GBP/JPY is trending downwards.

GBP/JPYs next support zone of 151.000 and the next resistance zone is at 153.800.

Look for short-term buying opportunities of GBP/JPY.

EUR/JPY Outlook (02 September 2021)

Overall, EUR/JPY is ranging across. Recently, EUR/JPY broke the resistance zone of 130.000.

The eurozone Unemployment Rate data (Actual: 7.6%, Forecast: 7.6%, Previous: 7.8% revised from 7.7%) released yesterday indicated decline in unemployment in July.

EUR/JPYs next support zone is at 130.000 and the next resistance zone is at 132.000.

Look for short-term buying opportunities of EUR/JPY.

Leave a Reply