USD Overview (30 July 2021)

Yesterday, USD weakened against all major currencies.

The Advance GDP q/q data (Actual: 6.5%, Forecast: 8.5%, Previous: 6.4%) released yesterday indicated that economic growth in the second quarter fell short of expectation.

The Core PCE Price Index m/m data (Forecast: 0.6%, Previous: 0.5%) will be released later at 2030 (GMT+8).

FOMC committee member Brainard will be speaking tomorrow at 0830 (GMT+8).

NZD/USD Outlook (30 July 2021)

Overall, NZD/USD is ranging across. Recently, NZD/USD bounced off the support zone of 0.69500.

The New Zealand Building Consents m/m data (Actual: 3.8%, Forecast: NA, Previous: 4.3% revised from -2.8%) released earlier today indicated an increase in the number of building permits issued in June.

Currently, NZD/USD is testing to break above the key level of 0.70. Its next support zone is at 0.69500 and the next resistance zone is at 0.71000.

Look for short-term selling opportunities of NZD/USD if it fails to break above the key level of 0.70.

AUD/USD Outlook (30 July 2021)

Overall, AUD/USD is trending downwards.

Currently, AUD/USD is testing to break above the key level of 0.74. Its next support zone is at 0.73300 and the next resistance zone is at 0.75000.

Look for short-term selling opportunities of AUD/USD if it fails to break above the key level of 0.74.

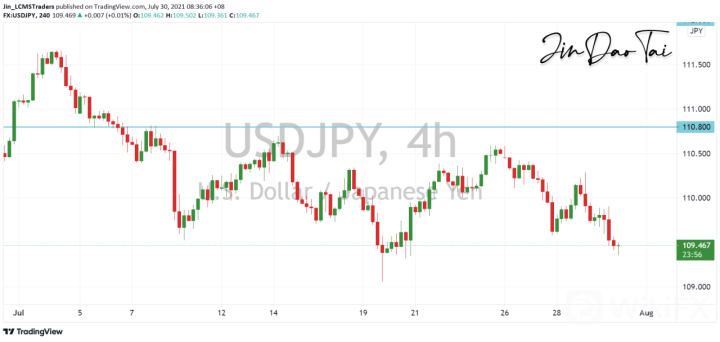

USD/JPY Outlook (30 July 2021)

Overall, USD/JPY is ranging across.

The Japanese Unemployment Rate data (Actual: 2.9%, Forecast: 3.0%, Previous: 3.0%) released earlier today indicated a slight decline in jobless rate in June.

USD/JPYs next support zone is at 108.500 and the next resistance zone is at 110.800.

Look for short-term selling opportunities of USD/JPY.

EUR/USD Outlook (30 July 2021)

Overall, EUR/USD is ranging across. Recently, EUR/USD broke the resistance zone of 1.18200.

The eurozone CPI flash estimate y/y, preliminary flash GDP q/q and unemployment rate data will be released later at 1700 (GMT+8).

- CPI Flash Estimate y/y (Forecast: 2.0%, Previous: 1.9%)

- Core CPI Flash Estimate y/y (Forecast: 0.7%, Previous: 0.9%)

- Preliminary Flash GDP q/q (Forecast: 1.5%, Previous: -0.3% revised from -0.6%)

- Unemployment Rate (Forecast: 7.9%, Previous: 7.9%)

Currently, EUR/USD is moving towards the key level of 1.19. Its next support zone is at 1.18200 and the next resistance zone is at 1.20000.

Look for short-term selling opportunities of EUR/USD if it bounces down from the key level of 1.19.

GBP/USD Outlook (30 July 2021)

Overall, GBP/USD is ranging across. Recently, GBP/USD broke above the key level of 1.39.

Currently, GBP/USD is moving towards the resistance zone of 1.40000 and the next support zone is at 1.38000.

Look for short-term selling opportunities of GBP/USD if it bounces off the resistance zone of 1.40000.

USD/CAD Outlook (30 July 2021)

Overall, USD/CAD is ranging across. Recently, USD/CAD trended down into the support zone of 1.24500.

The Canadian GDP m/m data (Forecast: -0.3%, Previous: -0.3%) will be released later at 2030 (GMT+8).

Currently, USD/CAD is testing the support zone of 1.24500 and the next resistance zone is at 1.26100.

Look for short-term buying opportunities of USD/CAD if it bounces off the support zone of 1.24500.

GBP/JPY Outlook (30 July 2021)

Overall, GBP/JPY is ranging across. Recently, GBP/JPY broke above the key level of 153.

Currently, GBP/JPY is testing to break below the key level of 153. Its next support zone is at 151.000 and the next resistance zone is at 153.800.

Look for short-term selling opportunities of GBP/JPY if it breaks below the key level 153.

EUR/JPY Outlook (30 July 2021)

Overall, EUR/JPY is trending downwards. Recently, EUR/JPY broke the resistance zone of 130.000.

The eurozone CPI flash estimate y/y, preliminary flash GDP q/q and unemployment rate data will be released later at 1700 (GMT+8).

- CPI Flash Estimate y/y (Forecast: 2.0%, Previous: 1.9%)

- Core CPI Flash Estimate y/y (Forecast: 0.7%, Previous: 0.9%)

- Preliminary Flash GDP q/q (Forecast: 1.5%, Previous: -0.3% revised from -0.6%)

- Unemployment Rate (Forecast: 7.9%, Previous: 7.9%)

Currently, EUR/JPY is testing the support zone of 130.000 and the next resistance zone is at 132.000.

Look for short-term selling opportunities of EUR/JPY if it breaks the support zone of 130.000.

Leave a Reply