USD Overview (09 September 2021)

Yesterday, USD strengthened against all major currencies.

FOMC committee members Daly and Evans will be speaking later at 2305 (GMT+8).

Also, committee members Bowman and Williams will be speaking tomorrow at 0100 (GMT+8) and 0200 (GMT+8) respectively.

During these times, there may be volatility in USD.

NZD/USD Outlook (09 September 2021)

Overall, NZD/USD is trending upwards.

Currently, NZD/USD is testing the support zone of 0.71000 and the next resistance zone is at 0.72850.

Look for buying opportunities of NZD/USD if it bounces off the support zone of 0.71000.

AUD/USD Outlook (09 September 2021)

Overall, AUD/USD is ranging across.

RBA Deputy Governor Debelle will be speaking later at 1635 (GMT+8). During this time, there may be volatility in AUD.

Currently, AUD/USD is moving towards the support zone of 0.73300 and the next resistance zone is at 0.75000.

Look for selling opportunities of AUD/USD if it breaks the support zone of 0.73300.

USD/JPY Outlook (09 September 2021)

Overall, USD/JPY is ranging across.

USD/JPYs next support zone is at 108.800 and the next resistance zone is at 110.800.

Look for short-term buying opportunities of USD/JPY.

EUR/USD Outlook (09 September 2021)

Overall, EUR/USD is trending upwards. Recently, EUR/USD bounced up from the key level of 1.18.

The European Central Bank (ECB) will be announcing their monetary policy decision later at 1945 (GMT+8). It is expected that the central bank will hold monetary policy unchanged. No announcement on tapering of quantitative easing is expected from the ECB during the meeting for three reasons. Firstly, the COVID Delta variant in the eurozone is still an issue. Next, the recent rise in inflation in the eurozone is likely going to be downplayed as being temporary. Lastly, the central bank will be releasing its quarterly economic projection and it is likely that the ECB will want to wait for more projections to have a clear picture of the eurozone economic outlook.

The ECB will be holding a press conference at 2030 (GMT+8). During this time, volatility is expected in EUR.

EUR/USDs next support zone is at 1.17600 and the next resistance zone is at 1.19000.

Look for short-term selling opportunities of EUR/USD up until the ECB monetary policy announcement at 1945 (GMT+8).

GBP/USD Outlook (09 September 2021)

Overall, GBP/USD is ranging across. Recently, GBP/USD broke the support zone of 1.38000.

During the testimony yesterday, Bank of England Governor Bailey highlighted that the central bank does not think that the current level of inflation will be persistent. Also, Governor Bailey said that during the August monetary policy meeting, half of the committee members felt that the minimum necessary conditions were met to hike rates while the other half felt otherwise.

GBP/USDs next support zone is at 1.36000 and the next resistance zone is at 1.38000.

Look for selling opportunities of GBP/USD.

USD/CAD Outlook (09 September 2021)

.

Overall, USD/CAD is ranging across. Recently, USD/CAD tested but failed to break above the key level of 1.27.

During the monetary policy meeting yesterday, the Bank of Canada held its monetary policy unchanged. No tapering of quantitative easing was carried out.

Bank of Canada Governor Macklem will be speaking at an online press conference about the Economic Progress Report tomorrow at 0000 (GMT+8). During this time, there may be volatility in CAD

Currently, USD/CAD is testing to break above the key level of 1.27. Its next support zone is at 1.26100 and the next resistance zone is at 1.29000.

Look for buying opportunities of USD/CAD if it breaks above the key level of 1.27.

GBP/JPY Outlook (09 September 2021)

Overall, GBP/JPY is ranging across. Recently, GBP/JPY bounced down from the key level of 152.

During the testimony yesterday, Bank of England Governor Bailey highlighted that the central bank does not think that the current level of inflation will be persistent. Also, Governor Bailey said that during the August monetary policy meeting, half of the committee members felt that the minimum necessary conditions were met to hike rates while the other half felt otherwise.

GBP/JPYs next support zone is at 151.000 and the next resistance zone is at 153.800.

Look for selling opportunities of GBP/JPY.

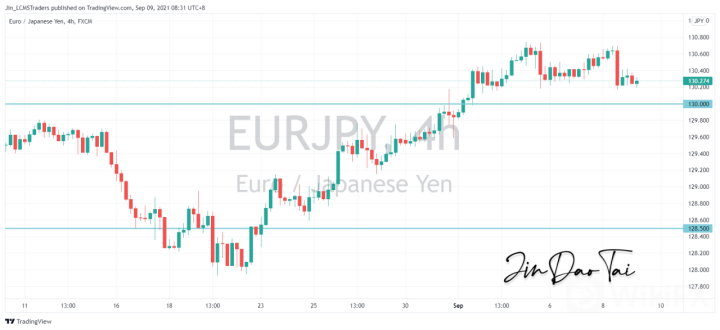

EUR/JPY Outlook (09 September 2021)

Overall, EUR/JPY is trending upwards.

The European Central Bank (ECB) will be announcing their monetary policy decision later at 1945 (GMT+8). It is expected that the central bank will hold monetary policy unchanged. No announcement on tapering of quantitative easing is expected from the ECB during the meeting for three reasons. Firstly, the COVID Delta variant in the eurozone is still an issue. Next, the recent rise in inflation in the eurozone is likely going to be downplayed as being temporary. Lastly, the central bank will be releasing its quarterly economic projection and it is likely that the ECB will want to wait for more projections to have a clear picture of the eurozone economic outlook.

The ECB will be holding a press conference at 2030 (GMT+8). During this time, volatility is expected in EUR.

Currently, EUR/JPY is moving towards the support zone of 130.000 and the next resistance zone is at 132.000.

If EUR/JPY breaks the support zone of 130.000, look for short-term selling opportunities up until the ECB monetary policy announcement at 1945 (GMT+8).

Leave a Reply