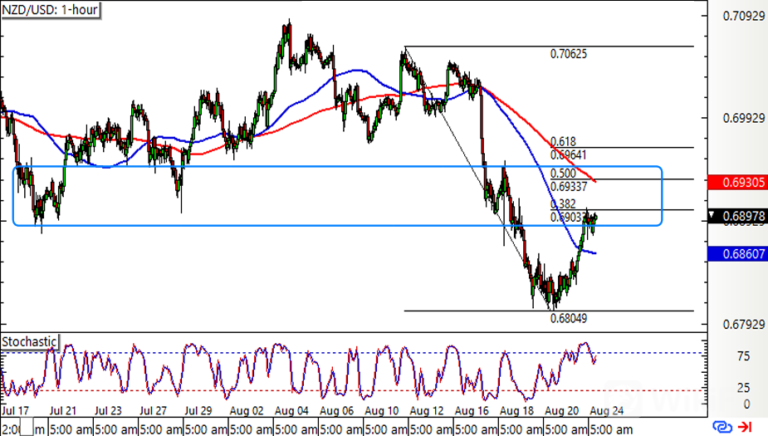

It‘s a textbook break-and-retest setup y’all!

NZD/USD fell through the floor at the .6935 area, dipping to a low of

.6805 before pulling back up. Right now, the pair is pulling back to

the area of interest.

Will it hold as resistance?

The Fibonacci retracement tool

reveals that the 50% level lines up with the former support zone,

adding to its strength as a potential ceiling. Thats right smack in

line with the 200 SMA dynamic resistance, too!

The 100 SMA is below the 200 SMA to confirm that resistance levels are more likely to hold than to break.

At the same time, Stochastic is already reflecting exhaustion among buyers and heading down to signal a pickup in bearish pressure.

Earlier on, the Kiwi drew support from upbeat quarterly retail sales data, along with hawkish comments from an RBNZ official.

But could the Greenback bring sexy back?

There are no major reports lined up from the U.S. in the upcoming

trading session, so any dollar moves might be based mainly on market

sentiment.

Aside from that, market watchers are expecting Fed head Powell to

discuss the central banks taper timeline during the Jackson Hole

Symposium. This could be enough to keep the Greenback supported leading

up to the event.

Just be on the lookout for a move past the 61.8% Fib that might

signal that Kiwi bulls are regaining the upper hand, and dont forget to

look at the average NZD/USD volatility

Leave a Reply