-

Summer trading conditions are still steering the markets broadly with the likes of the S&P 500 carving out a very restrained tempo – though running an extended advance

-

Thin markets can cap activity, but it can also exaggerate volatility significantly as with golds supposed Monday flash crash

-

The Dollar is on the cusp of a technical break out (breakdown for EURUSD) and rate speculation has accelerated, but can it overcome the quiet?

MARKET CONDITIONS RULE EVERYTHING AROUND ME, OR MCREAM

The new trading week has opened to a range of assets experiencing very different conditions. There is the US Dollar whose charge through the end of this past week was on the verge of a major technical break that instead slowed its pace despite the additional fundamental support in exactly the right theme. Then we have gold which experienced an extreme intraday volatility that has been called a ‘flash crash’ by some and ‘fat finger’ by others. And the vast majority of the most liquid market benchmarks like the S&P 500 are trading at a tempo that is both boring traders and making investors dependent on capital gains anxious. All of this I believe is symptomatic of the same underlying issue: thinned market conditions. While technical and fundamentals matter, their effectiveness depends on general conditions of the financial system to convert or absorb meaningful developments.

Chart of the S&P 500 SPY ETF with Volume, 100-Day SMA and Spot-SMA Disparity (Daily)

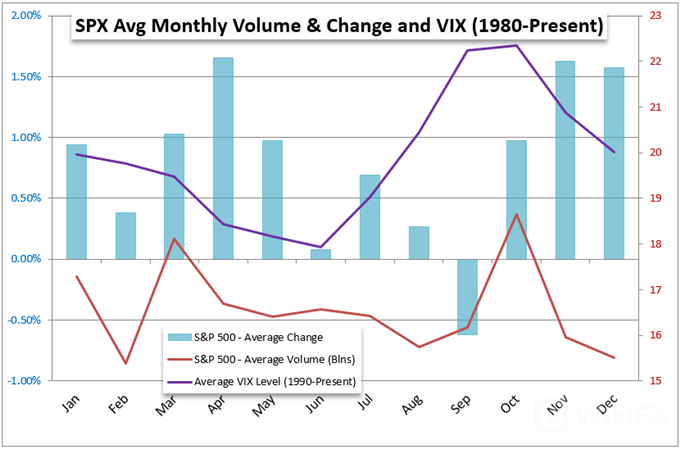

As a reminder of the general market conditions we are facing, I will once again reference the average performance of the S&P 500 and its market elements. In the month of August, this baseline for ‘risk appetite’ has averaged out one of its lowest volume months of the calendar year – the lowest if you adjust for active trading days. Yet, on the flip side of the same coin, that shallow market backdrop tends to amplify short bouts of volatility. I like to use the analogy of a shockwave moving through a large body of water. When an earthquake occurs in the middle of an ocean, the impact is barely noticeable from the surface. However, as the wave moves towards the shallower areas closing in on land, it turns into a tsunami – a catastrophic but short-lived event.

Chart of S&P 500 Seasonal Performance, Volume and VIX

We saw just how significant a drain in liquidity could distort a market this past session through gold. In the opening hours of trade during the Monday Asian session when market depth is perhaps its thinnest point of the week for a 24/5 market like this commodity, there was a sudden and dramatic tumble. In the span of less than 15 minutes, one of the most heavily traded assets in the world dropped more than 4 percent. There were some attributing the move to a technical break of 1760 which coincides with a meaningful trendline support / range floor combo while others suggested it was a delayed reaction to the charge in rate expectations in the US. Those factors could have helped get the ball rolling, but the intensity of the move almost certainly had to do with a large sell order not finding a market to absorb the offer. Yet, the thin liquidity cuts both ways such that a trend is an improbable scenario which the ‘buy the dip’ crowd would recognize readily enough. Until this spell is broken, the opportunistic range traders will continue to swoop in on these types of developments.

Chart of Spot Gold with Daily ‘Tails’ (Daily)

WHERE THE FUNDAMENTALS REALLY GAINED TRACTION: US MONETARY POLICY

Last week, when I was off the desk, the Dollar started to make some serious progress. The real traction came on Friday specifically following the Bureau of Labor Statistics reporting of the July employment numbers. Nonfarm payrolls didn‘t exactly blow expectations out of the water (they were a modest 75,000 or so above consensus), but the nearly 1 million additional jobs to the world’s largest economy was the biggest jump in overall employment since August of last year. In addition to the drop in the jobless rate and robust 0.4 percent increase in average hourly wages, there real heft in this run was the swell in monetary policy expectations. We furthered that anticipation this past session through Atlanta Fed President Bostics remarks whereby he suggested he supported a hike by the end of 2022 should the economy remain on its current trend. Further, he currently supports a taper starting in the October to December period but could be convinced of a September start should the data bare it out. While Bostic no doubt speaks for himself, it is clear that each FOMC member is also representing the central bank at large with guidance and messaging their most actively used tool. I find his remarks critical, but will the market?

Chart of DXY Dollar Index Overlaid with Fed Implied Hikes Dec 2022 (Daily)

Despite the fact that Bostic‘s remarks further the fundamental implications of last week’s top data, the market showed limited enthusiasm for follow through to the point of a critical breakout for the Greenback. For the ICE‘s Dollar Index, that would be a clearance through 93 while EURUSD would roughly translate the line in the sand around 1.1700. We are within easy reach of these critical levels and the fundamental nudging is there, but once again, such an attempt would contravene market conditions. I like both the technical barriers and believe the fundamental pressure to be legitimate, but my priority remains with market conditions. In this, the retail trader’s preference for range conditions, which is on full display in the IG Client Sentiment reading for EURUSD, may find the masses in the more probable path.

THE FUNDAMENTAL POTENTIAL AHEAD

While I do hold market conditions in higher regard than other analytical elements, there is inevitable change to aspect of the financial system just as any other. It is possible that the summer-bound masses can be brought back to the market by an overwhelming urge. I believe that the power of fear in risk aversion is the most universal influence, but the water mark on that front is very high. Short of that engulfing stimulus, we may find a little more sway in the collective sentiment data due over the next 24 hours from Australian and US business confidence to Japanese and Eurozone economic readings. That said, given the preexisting volatility of the Dollar, the scheduled speech from perhaps the Feds most dovish member, Chicago Fed President Evans, will draw my distinct interest for the currency, yields and many more financial outlets.

Key Global Macro Economic Event Risk Calendar

Leave a Reply