● The US Federal Reserve disappointed markets by showing no rush to taper.

● The US economy is expected to have added roughly 1 million jobs in July.

● EUR/USD has recovered nicely, but a course change has not been confirmed.

The EUR/USD pair reached fresh July highs on the last trading day of the month, settling just below the 1.1900 level. The pair has advanced ever since the week started but gained momentum on Wednesday after the US Federal Reserve smashed the dollar.

Whats next in the calendar?

The upcoming week is a busy one, with the focus on US employment data. The country will publish on Wednesday the ADP survey on private jobs creation, foreseen at 600K. On Thursday, the country will release weekly Initial Jobless Claims and Challenger Job Cuts ahead of the Nonfarm Payroll report, out on Friday. At the time being, analysts foresee that 926K new jobs were added in July. The monthly employment report could be a game-changer if the number surpasses the 1 million threshold.

Beyond employment figures, the US will also publish the official July ISM indexes on manufacturing and services output, while Markit will release the final versions of its July PMIs.

Germany will publish June Retail Sales on Monday, while the EU will do it on Wednesday. EUs Markit PMIs for July will be out on Monday and Wednesday. By the end of the week, Germany will release June Factory Orders and Industrial Production for the same month.

EUR/USD technical outlook

Technically, the weekly recovery seems a mere correction in the wider perspective. The pair keeps developing below the 61.8% retracement of the March/May rally at 1.1920. In the weekly chart, the 20 SMA maintains its bearish slope around the 50% retracement of the same rally at 1.1985. Technical indicators stand within negative levels, with the Momentum modestly recovering but the RSI still flat.

The pair offers a mildly positive stance in the daily chart, as it is advancing above a flat 20 SMA, currently providing dynamic support at around 1.1820. The longer moving averages remain directionless around the 1.2000 area, while technical indicators recovered ground but lost momentum just above their midlines.

For the days ahead, resistance levels are the mentioned Fibonacci figures at 1.1920 and 1.1985. On the other hand, support levels come at 1.1840, the monthly low at 1.1751. and finally, 1.1703, where it bottomed in March.

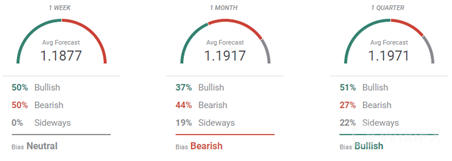

EUR/USD sentiment poll

According to the FXStreet Forecast Poll, the EUR/USD pair would consolidate in the near-term, as the number of bulls equals that of bears. The pair is seen on average trading just ahead of the 1.1900 level. The number of bears overlaps that of bulls in the monthly perspective, but those going long are looking for higher targets, lifting the average to 1.1917. The pair is bullish in the monthly perspective, as bears decrease to 27%, with the pair seen near 1.2000.

According to the Overview chart, it seems that bulls are slowly coming back. The moving averages turned higher, with different degrees of strength. The weekly moving average is the one showing the strongest momentum, with the long-term media still showing a limited bullish potential.

Leave a Reply