EUR/USD Weekly Forecast: The song remains the same.

· Fed tapering talks back on the table, eyes on the September meeting.

· US employment data next week will be critical for the next monetary policy steps.

· The EUR/USD pairs corrective advance may soon come to an end.

The EUR/USD pair managed to recover some ground, settling at around 1.1770. The US dollar eased throughout the first half of the week on cooling tapering expectations as the coronavirus Delta variant storms the States, affecting the countrys growth potential.

Taper talk back in the spotlight

The dollars weakness cooled on Thursday as a couple of Federal Reserve officials revived speculation of soon-to-come tapering. Robert Kaplan, Dallas Fed President, said that September would be the time to outline tapering and start it in October, while James Bullard from St. Louis made comments in the same direction. More comments came from Kansas City Fed President Esther George, who said Thursday the US central bank should begin winding down its massive bond-buying program “sooner rather than later.”

Slower pace of growth

Other growth-related data released these days failed to impress. US Q2 Gross Domestic Product was upwardly revised to 6.6% from 6.5%, slightly below the 6.7% expected. German GDP in the same period was confirmed at 1.6%, also improving from its preliminary estimate. However, US Durable Goods Orders declined by 0.1% in July, while sentiment-related indicators in the Union missed the markets expectations.

EUR/USD technical outlook

Overall, summer doldrums keep major pairs within familiar levels, and EUR/USD´s advance could be well considered corrective, as the pair had recovered roughly 100 pips after reaching a fresh 2021 low at 1.1663.

The EUR/USD pair is currently developing below the 23.6% retracement of the May/August decline at 1.1805. Bulls may have some chances if the price extends beyond the latter, but until then, bears hold the grip.

The weekly chart shows that the 20 SMA offers a mildly bearish slope well above the current level, while the 100 and 200 SMA converge around 1.1560. Meanwhile, technical indicators have pared their declines but remain near their recent multi-week lows. On the daily chart, the pair is struggling around a bearish 20 SMA, while technical indicators hover around their midlines without strength enough to confirm further gains.

Beyond the 1.1805 level, the next resistance is 1.1890, the 38.2% retracement of the mentioned monthly decline. Sellers will likely add on approaches to it. The year low at 1.1663 is the immediate support level, followed by 1.1540. A break below the latter will open the door for a test of 1.1470, a long-term static support level.

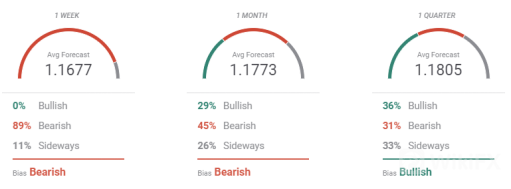

EUR/USD sentiment poll According to the forecast poll, it shows that bears are in full control of the pair, with 89% of the polled experts betting for a decline in the near term. The average target is at 1.1677, as the pair is not yet seen piercing the 1.1600 figure. The sentiment in the monthly view is also controlled by bears, while bulls are a modest 36% majority in the quarterly view.

In the Overview chart, the weekly moving average has bounced modestly, but the longer ones maintain their bearish slopes, somehow hinting at possible lower lows. With a few exceptions that distort the average, the pair is expected to remain between 1.16 and 1.20 in the next three months.

Leave a Reply