The US dollar is currently thrusting a positive recovery from the steady decline experienced since the month of August especially last week's NFP report that showcased the lowest increase in Job creation. The US president Mr. Biden has reassured investors last week that US economy and labor market can withstand the ups and downs of Corona Virus Delta Type change which has been the major cause of decline in the US dollar since the month of August and affected job creations. Consequently, investors are gradually shifting their focus from Gold and Crude Oil towards investment in dollar and other assets.

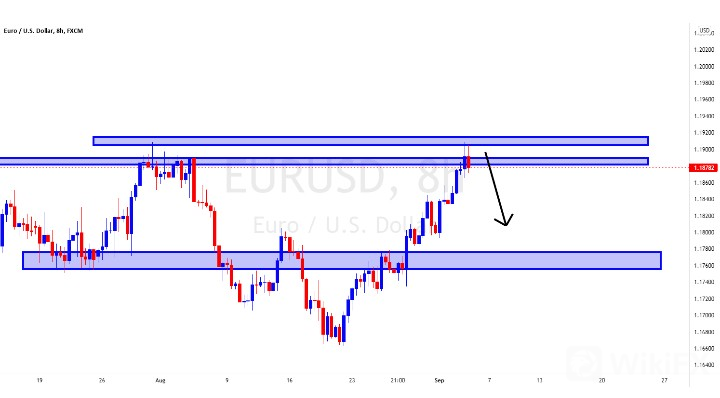

Fundamental Analysis on EURUSD: A Bearish divergence expected.

EURUSD is set for a decline in the coming week with Dovish members calling for a mild outlook on policies. A majority of hawkish members of the European Central Banks policymaking Governing Council had announced last week that Eurozone monetary policy will need to be tightened. Thereby increasing the increasing the interest rate. This will definitely give EURO a stronger bearing if they succeed.

However, members of the council with Dovish disposition are currently dominating and opposing this position calling for a mild outlook in the monetary policy as to support more borrowing and economic growth amidst the increase in unemployment rate. The doves led by President Christine Lagarde are almost certain to maintain their majority on the Council, insisting that the overshoot of the inflation target will be temporary and that there should be no indication of a future tightening of policy to be announced at this week's council. Christine told the house last week following the that data presented at the council meeting that there has been a large fall in the final August reading of the Eurozone services PMI and an unexpected drop in German retail sales year/year in July. This decline in the German retail sales would no doubt set in a bearish divergence for EUR/USD, that has been soaring higher since the month of August.

More so, the ECB is currently beset with the challenge arising from the recent global call for a climate change which could further diminish the space for conventional monetary policy by lowering the equilibrium real rate of interest, which balances savings and investment. The European Central banks themselves are exposed to potential losses—from securities acquired in asset purchase programs and on the collateral provided by counterparties in monetary policy operations. It is therefore less likely that there will be any news on the tightening of monetary policy during this week's session. This no doubt will give room for a bearish divergence in the prices of Euro.

Technical Analysis on GOLD XAUUSD): Bearish Movement expected.

The previous metal gold has risen higher last week's Friday after the Non Farm Pay roll (NFP) data which indicated that the US has experienced a slow increase in job creations.

However, with the US dollar gradually set to recover ahead of the new week, Gold prices currently at a confluence point will definitely experience some pullbacks. Investors are set to take profits temporarily from their investment in the precious metal as they await the outcome of the new week NFP.

Technical Analysis on Crude Oil: Downside movement expected.

The prices of Crude Oil having soared higher last week after the NFP is currently sitting on a strong resistance at $69.2 per barrel. However, with the gradually recovery of the US dollar and emphasis on climate change, investors are set to gradually move away from Crude Oil to other assets. We therefore expect a strong decline in the price of Crude Oil this new week.

Leave a Reply