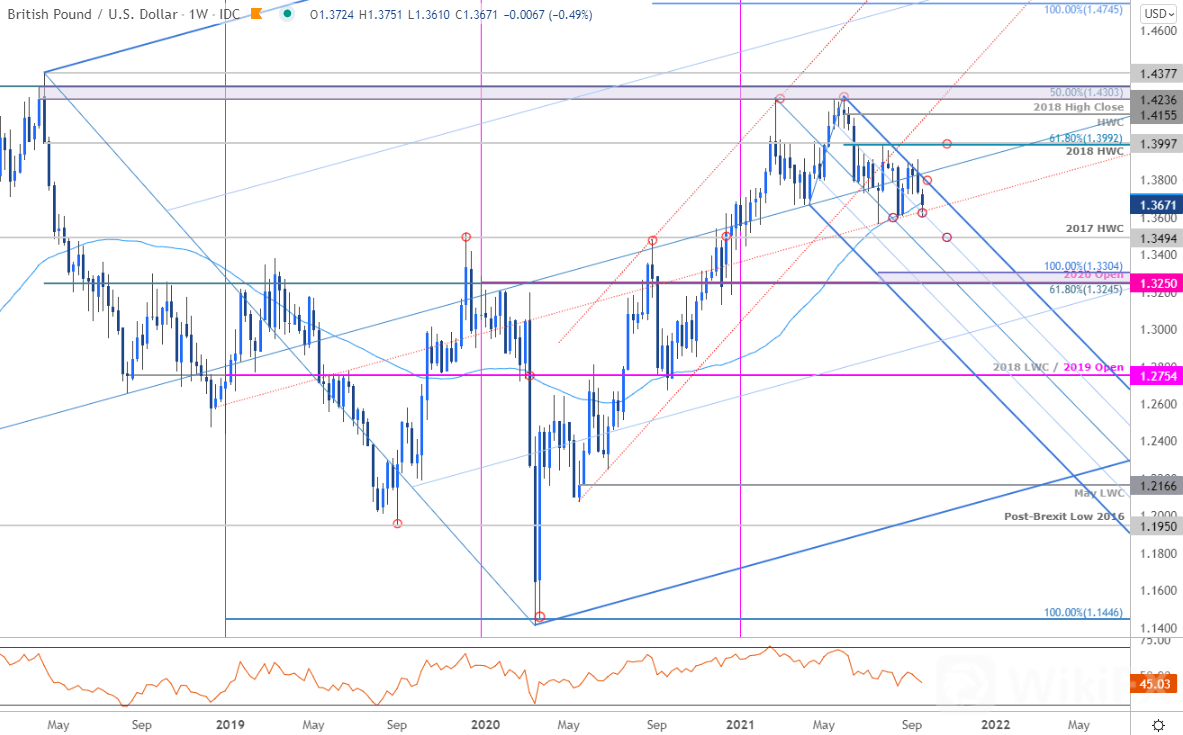

The British Pound marked a third consecutive weekly decline against the US Dollarthis week with GBP/USD nearly 0.5% to trade at 1.3671 ahead of the close of US trade on Friday. The decline highlights a consolidation range at trend extremes and were on breakout watch in the weeks ahead. These are the updated targets and invalidation levels that matter on the GBP/USD weekly chart.

A break / close below this weeks low is needed to mark resumption with such a scenario exposing subsequent objectives at the 2017 high-week close at 1.3494 and critical support at 1.3245 – 1.13304- a region defined by the 61.8% Fibonacci retracement off the 2018 decline, the 2020 yearly open and the 100% extension of the June decline. Initial weekly resistance stands with the upper parallel (currently ~1.38) with a close above the 2018 high-week close / 61.8% retracement at 1.3992/97 needed to shift the broader focus back to the topside in the British Pound.

Sterling is in consolidation just below multi-month downtrend resistance with GBP/USD carving a series of lower highs and higher lows just above multi-year uptrend support. From a trading standpoint, the focus is on a breakout of the monthly range for guidance with the broader outlook still weighted to the downside while within this formation. Note that a break lower here could fuel another bout of accelerated losses- stay nimble. Look for rallies to be capped by the 1.38-handle IF price is indeed heading lower. Ultimately , a larger correction may offer more favorable opportunities closer to trend support. Review my latest Sterling Price Outlook for a closer look at the near-term GBP/USD technical trade levels.

Stay tuned!

Leave a Reply