After climbing above $1,770 during the European trading hours, the XAU/USD pair came under strong bearish pressure in the second half of the day and dropped to a daily low of $1,749.60. The sharp upsurge witnessed in the US Treasury bond yields in the American session seems to be weighing heavily on gold. At the moment, the benchmark 10-year US T-bond yield is at its highest level since mid-July at 1.4%, gaining 7.2% on a daily basis. Meanwhile, the greenback is struggling to find demand in the risk-positive market environment and helping gold limit its losses for the time being.

Gold Price Technical Analysis

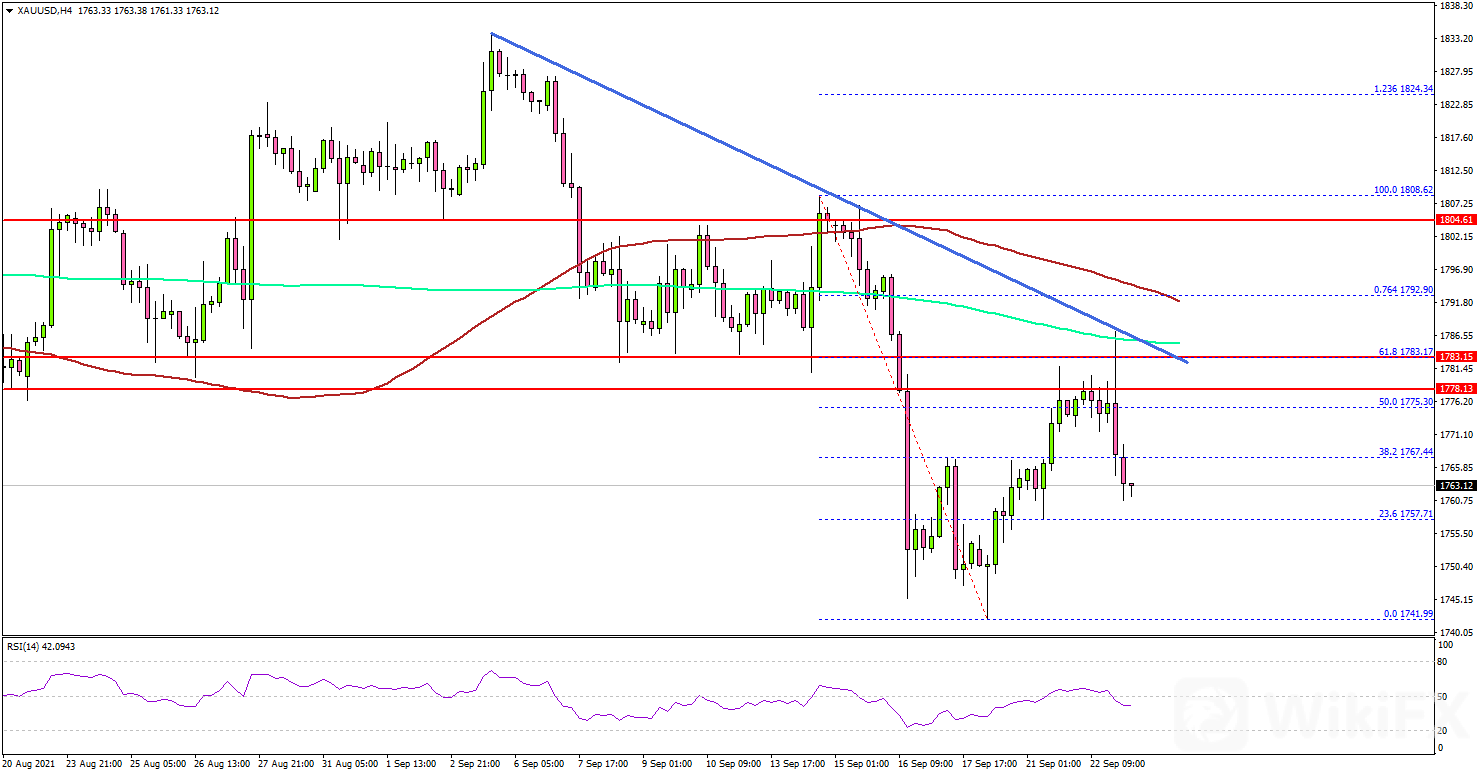

This past week, gold saw a bearish reaction below the $1,800 support against the US Dollar. The price broke the $1,780 support to move into a negative zone.

The 4-hours chart of XAU/USD indicates that the price even broke the $1,760 and $1,750 support levels. There was a daily close below $1,800, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

The price traded as low $1,741 and recently started an upside correction. The price corrected above the $1,765 and $1,770 levels.

There was a break above the 50% Fib retracement level of the key decline from the $1,808 swing high to $1,741 low. However, the price is facing an uphill task near the $1,785 and $1,790 levels.

There is also a major bearish trend line forming with resistance near $1,786 on the same chart. The next major resistance is near the $1,792 level and the 100 simple moving average (red, 4-hours). It is close to the 76.4% Fib retracement level of the key decline from the $1,808 swing high to $1,741 low.

The main hurdle sits at $1,800, above which the price could rise towards $1,825. Any more gains could lead the price towards the $1,850 level.

Stay tuned!

Leave a Reply