It‘s been previously discussed that October tends to be a bullish month for gold prices, typically as risk appetite wanes in other parts of financial markets. But this October, there’s much ado about nothing – so far. Gold prices traded up near 1760 on October 1, and since then, have spent every day trading right around 1760.

Now that the US debt ceiling debate has been kicked down the road to December, and fears around China‘s property market are simmering – some days bring worse news than others, but nothing too significant yet – there aren’t many viable catalysts for a significant gold price rally on the horizon. And with the fact remaining that the FOMC continues to offer clear signals that tapering is arriving soon, gold prices still have considerable fundamental headwinds working against them.

Historically, gold prices have a relationship with volatility unlike other asset classes. While other asset classes like bonds and stocks don‘t like increased volatility – signaling greater uncertainty around cash flows, dividends, coupon payments, etc. – gold tends to benefit during periods of higher volatility. Recent signs of falling gold volatility aren’t a good omen for gold prices.

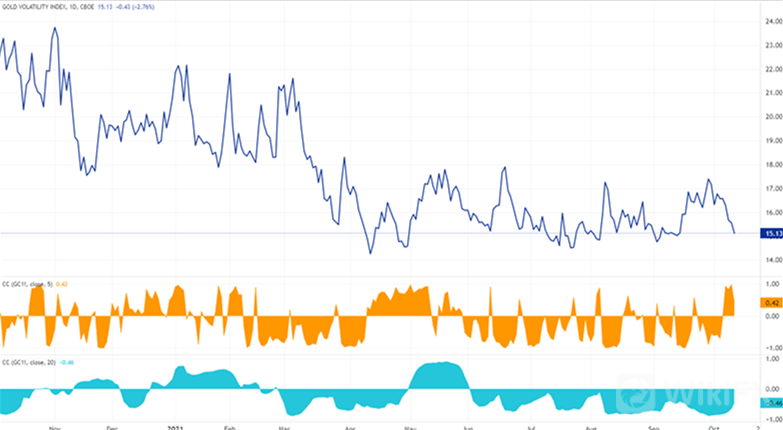

Gold volatility (as measured by the Cboes gold volatility ETF, GVZ, which tracks the 1-month implied volatility of gold as derived from the GLD option chain) was trading at 16.52. The relationship between gold prices and gold volatility is normalizing, insofar as the 5-day correlation is becoming less positive this week while the 20-day correlation remains in negative territory. The 5-day correlation between GVZ and gold prices is +0.42 while the 20-day correlation is -0.46. One week ago, on October 5, the 5-day correlation was -0.70 and the 20-day correlation was -0.84.

Gold prices‘ technical structure on the weekly timeframe remains weak in spite of the recent rebound on lower timeframes. The weekly 4-, 13-, and 26-EMA envelope’s negative slope remains in place, while weekly MACD continues to drop further below its signal line. Weekly Slow Stochastics are holding at the median line, however. For now, the outlook persists that “selling the rally may be the modus operandi henceforth.”

Leave a Reply