Gold prices have been idling since last week‘s explosive one-day selloff, with traders seemingly waiting on the next clue in the ongoing Fed policy outlook debate before committing one way or another. That trigger may come by way of August’s US CPI report.

A modest cooling is expected, with the core inflation rate inching down for a second month to hit 4.2 percent on-year. That would still put price growth well above average of 2.2 percent average prevailing in the past three decades. Indeed, the last time 4 percent was breached before 2021 was in 1991.

Leading PMI survey data as well as wage growth figures embedded in August‘s official US labor-market figures suggest an upside surprise may be in the cards. That may stoke speculation of a hawkish outturn at next week’s FOMC meeting, weighing on non-interest-bearing and perennially anti-fiat bullion.

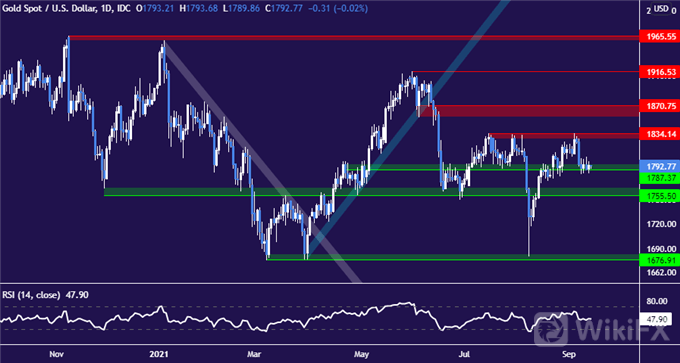

GOLD TECHNICAL ANALYSIS – WAITING FOR DIRECTION NEAR 1800 FIGURE

Gold prices await direction at familiar support. A daily close below 1787.37 may set the stage for a decline to test support running down into 1755.50. A push below the US$1700/oz figure and eyeing 2021 lows near 1676.91 may follow thereafter.

Key resistance remains at 1834.14, a barrier that has decisively capped upside progress since mid-July. Breaking above that es the next layer of resistance running up into 1870.75. Another push above the $1900 figure to challenge Mays swing top at 1916.53 might be in scope beyond that.

Leave a Reply