-

Gold prices ranged at around $1,785 for the past week, waiting for fresh catalysts

-

The Jackson Hole symposium will be closely eyed by bullion traders for clues about the Feds tapering timeline

-

Breaking above $1,785 may open the door for further gains, whereas a pullback may bring $1,750 into focus

Gold held steadily during Monday‘s APAC session as bullion traders awaited for the Jackson Hole symposium later this week. The latest FOMC meeting minutes signaled that a majority of Fed members support an idea to scale back the $120 billion per month in asset purchases by the end of this year. Fed Chair Jerome Powell’s speech on Friday may strengthen this prospect, although recent economic data has shown signs of a slowing recovery.

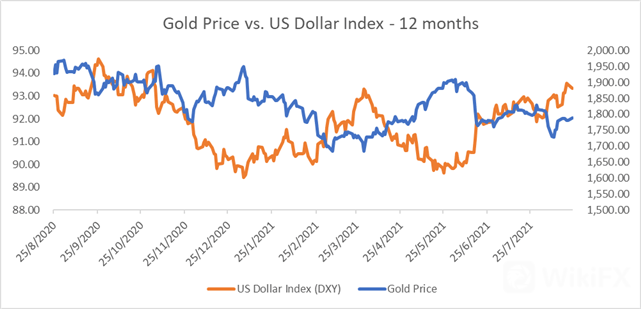

Against this backdrop, the DXY US Dollar index advanced to an eight-month high as market participants attempted to price in tightened liquidity conditions towards the end of the year. As a result, gold prices faced strong resistance to move up despite escalating geopolitical tensions in Afghanistan.

Gold Price vs. US Dollar Index – Past 12 Months

Looking ahead, traders are eyeing Fridays UScore PCE inflation data for clues about rising price levels and their ramifications for the Fed policy. The figure is expected to hit 3.54% YoY in July, marking the highest level since 1992. A stronger-than-expected reading may strengthen the prospect for tapering and weigh on gold prices, whereas a weaker one may lead to the reverse.

Technically, gold prices are about to challenge an immediate resistance level at 1,785 – the 61.8% Fibonacci retracement. A failed attempt to breach 1,785 may lead to a pullback towards 1750 for immediate support. The MACD indicator is about to form a bullish crossover, suggesting that upward momentum may be building.

Gold – Daily Chart

Leave a Reply