Market Wrap: Bitcoin Consolidates as Altcoin season heats up

Bitcoins rally is taking a breather as altcoins outperform.

traded sideways on Monday and is holding support above the 200-day moving average of about $46,000. The cryptocurrency was changing hands at around $48,000 at press time and is roughly flat over the past 24 hours. Analysts expect bitcoin to remain rangebound heading into the end of the month as investors show a strong preference for altcoins.

“BTC price continues to hover above its 200-day moving average with the bulls still in play,” Lukas Enzersdorfer-Konrad, chief product officer at crypto trading platform Bitpanda, wrote in an email to CoinDesk.

Improving blockchain data is one reason why bulls remain active above support levels.

“Fundamental factors have improved in recent weeks as the hash rate has now recovered to early Junes levels, indicating that miners are coming back online after China shut down its activities,” Enzersdorfer-Konrad wrote.

Latest Prices

Bitcoin (BTC) $48,591 -0.6%

Ether (ETH) $3,339 +3.9%

S&P 500: +0.4%

Gold: -0.4%

10-year Treasury yield: 1.278%, down 0.034 percentage point

Enzersdorfer-Konrad also pointed to the recent surge in altcoins as bitcoin consolidates, which could reflect an appetite for greater risk among investors.

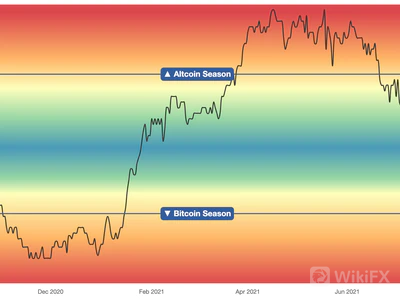

The “alt-season index,” which tracks the relative performance across cryptocurrencies over the past 30 days, shows a clear skew toward altcoins. On a yearly basis, however, altcoin performance still has some room to catch up to bitcoin, as shown in the chart below.

Bitcoin accumulation demand

Blockchain data shows large accumulation demand for bitcoin, which underpinned the recent relief rally.

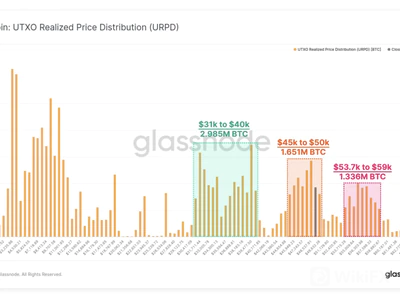

The “bitcoin price is currently sitting at the top end of a strong on-chain support zone,” Glassnode tweeted on Monday.

The chart below shows bitcoins realized price distribution. Each bar represents the number of existing bitcoin that last moved within the specified price bucket. The green-shaded region shows strong accumulation support in the $31,000 to $40,000 price range.

More than 1.6 million BTC now have a cost basis within the $45,000 to $50,000 range, which has also experienced accumulation, according to Glassnode data.

Investors add to altcoin funds

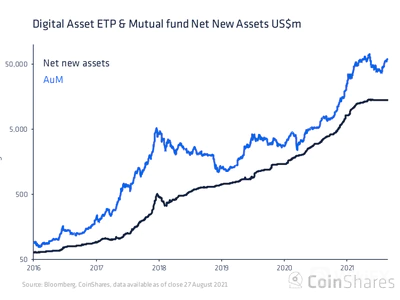

Bitcoin investment products recorded their eighth consecutive week of outflows, totaling $3.8 million, but altcoin funds continued to attract fresh capital, a report Monday showed.

Overall, crypto funds netted inflows totaling $24 million during the week ended Aug. 27, down about $3 million from the prior week, according to the report by digital asset investment manager CoinShares.

Funds focused on the cardano altcoin saw inflows totaling $10.1 million over the past week as the price of cardano has doubled over the past month.

Leave a Reply