Market Overview

On Monday (January 9) in Asia, spot gold rose in shock, hitting an eight month high of 1879.36 US dollars/ounce. Due to the poor performance of the US economic data last week, the Federal Reserve in the market will narrow the interest rate increase in January, and the yield of US bonds fell to a low level in nearly two weeks. After the sharp fall of the US dollar index last Friday, the decline continued on Monday, approaching a low level for more than half a year, providing momentum for the gold price to rise.

The market began to turn its attention to the US December CPI data to be released on Thursday. This trading day focused on the speech of Fed officials, news related to geographical situation and changes in market risk appetite.

Mohicans Markets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on January 9, 2023 Beijing time.

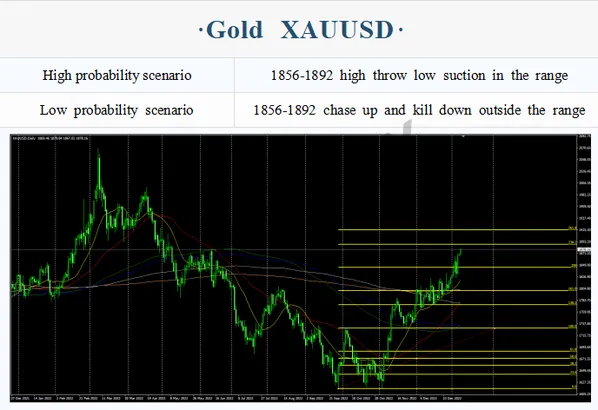

Intraday Oscillation Range: 1833-1856-1873-1890

Overall Large OscillationRange: 1730-1756-1780-1801-1817-1833-1856-1873-1890-1911

Spot goldin the subsequent period, 1833-1856-1873-1890can be operated as an intradayrangeof bullish and bearish;high throw low suction in the range, chase up and kill downoutside the range!

Note: The above strategy was updated at 15:00 on January 9. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 23.1-23.9-24.5-25.3

Overall Large OscillationRange: 20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1

Spotsilverin the subsequent period,23.1-23.9-24.5-25.3can be operated asan intradayrangeof bullish and bearish;high throw low suction in the range, chase up and kill downoutside the range!

Note: The above strategy was updated at 15:00 on January9. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 72.3-73.1-73.8-75.1-77.3

Overall Large OscillationRange:

70.1-71.2-72.3-73.1-73.8-75.1-77.3-78.5-79.9-81.3-82.1-83.5

Crude Oilin the subsequent period,72.3-73.1-73.8-75.1-77.3can be operated asan intradayrangeof bullish and bearish;high throw low suction in the range, chase up and kill downoutside the range!

Note: The above strategy was updated at 15:00 on January9. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range:1.0570-1.0690-1.0755

Overall Large OscillationRange:

1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0910

EURUSDin the subsequent period,1.0570-1.0690-1.0755can be operated asan intradayrangeof bullish and bearish;high throw low suction in the range, chase up and kill downoutside the range!

Note: The above strategy was updated at 15:00 on January9. This policy is a daytime policy. Please pay attention to the policy release time.

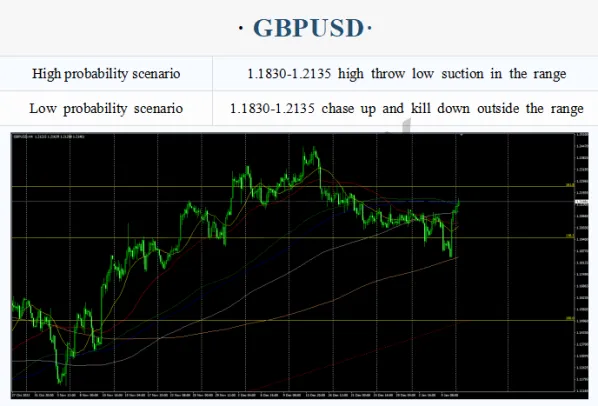

Intraday Oscillation Range:1.1920-1.2030-1.2135-1.2250

Overall Large OscillationRange:

1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2400-1.2470

GBPUSDin the subsequent period,1.1920-1.2030-1.2135-1.2250can be operated asan intradayrangeof bullish and bearish;high throw low suction in the range, chase up and kill downoutside the range!

Note: The above strategy was updated at 15:00 on January9. This policy is a daytime policy. Please pay attention to the policy release time.

Leave a Reply