Jul 5, 2021, 8:28:45 AM

EUR/USD: euro consolidates near 1.1850

Current trend

EUR has shown a slight decline against USD during the Asian session, returning to the usual “bearish” trend after last Friday's growth.

The instrument declined at the end of last week, awaiting the publication of the report on the US labor market for June, but after its release, despite moderate optimism from the data, traders began to massively close short positions on EUR. Anyway, the report reflected an increase in Nonfarm Payrolls by 850K in June after rising by 583K in May. Experts expected the growth by 700K only. At the same time, the Unemployment Rate in June unexpectedly rose and reached 5.9%.

In turn, EUR received support from the data on producer inflation. The Producer Price Index in the euro area rose 1.3% MoM in May after rising 0.9% MoM in April. In annual terms, the indicator accelerated from +7.6% YoY to +9.6% YoY.

Support and resistance

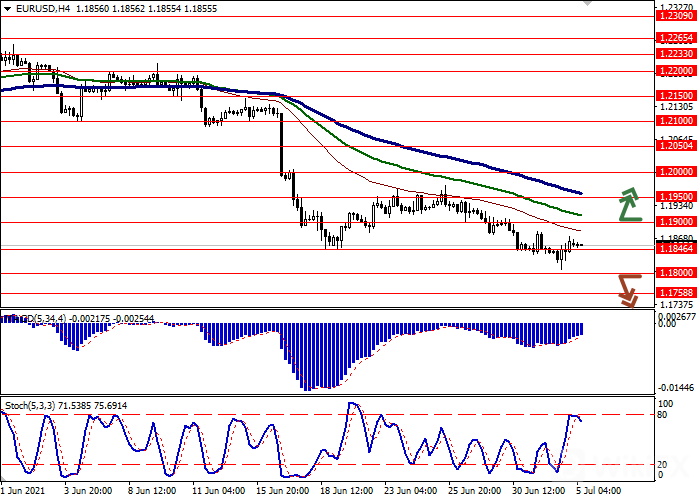

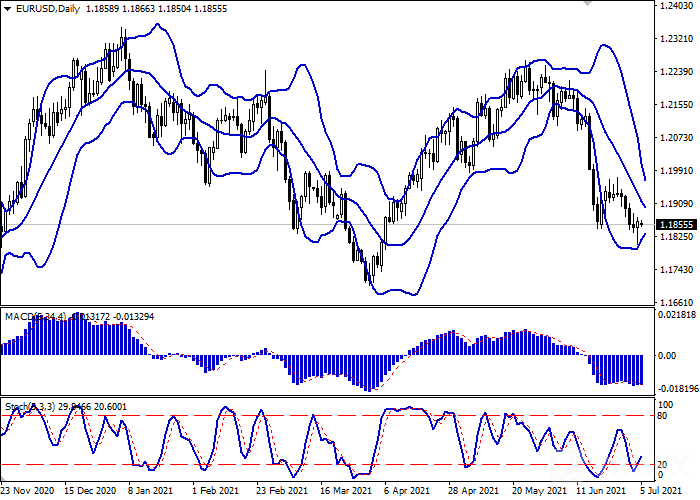

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is narrowing, reflecting the emergence of ambiguous dynamics of trading in the short term. MACD indicator tries to reverse to growth and to form a new buy signal (the histogram should consolidate above the signal line). Stochastic, having reversed near its lows, demonstrates a similar dynamics. Current readings of the indicators signal in favor of a corrective growth in the ultra-short term.

Resistance levels: 1.1900, 1.1950, 1.2000, 1.2050.

Support levels: 1.1846, 1.1800, 1.1758, 1.1700.

Trading tips

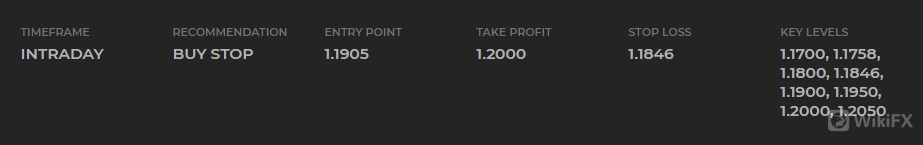

To open long positions, one can rely on the breakout of 1.1900. Take-profit – 1.2000. Stop-loss – 1.1846. Implementation time: 2-3 days.

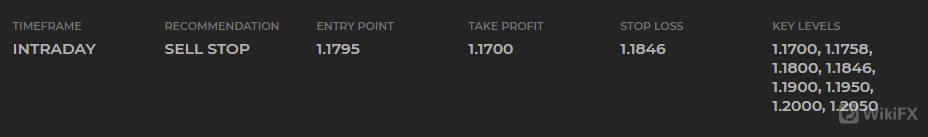

The return of “bearish” trend with the breakdown of 1.1800 may become a signal for new sales with the target at 1.1700. Stop-loss – 1.1846.

Scenario

Alternative scenario

Leave a Reply