Day Trading Tips And Tricks

These day trading tips and tricks will give you a leg up when working to succeed in your career as a trader.

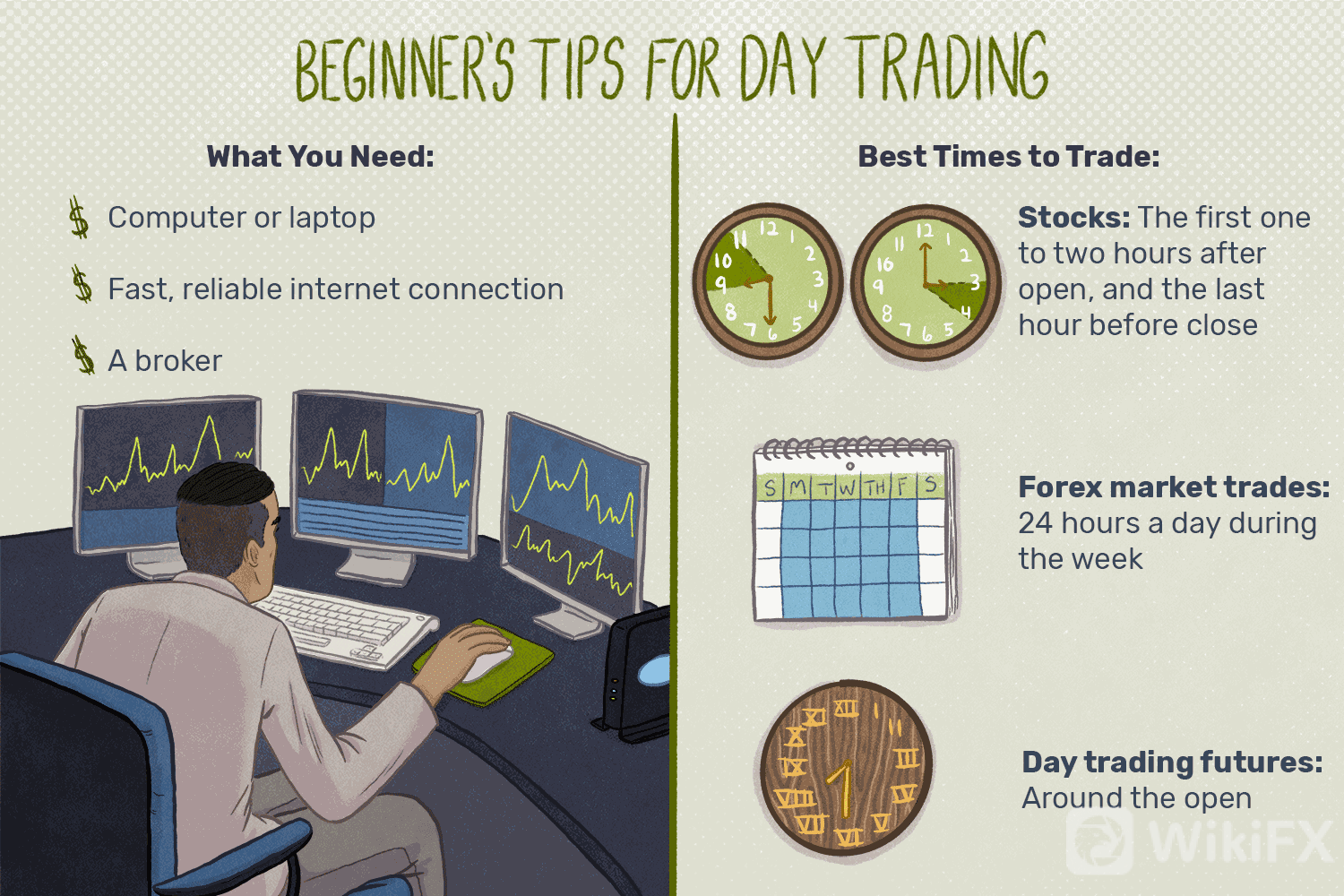

With the rise of the internet and the ease of access with which anyone who has a stable connection is able to tap into financial markets, day trading has become an extremely lucrative and viable career opportunity for disciplined and savvy traders.

With just a little bit of capital and a rigid schedule, and a comfortable workspace, day traders everywhere have quit the office with no intention of ever going back.

It‘s not easy to succeed as a day trader (why else wouldn’t everyone do it?!?), but if you stick to your plan and follow a few key tips, independence and prosperity might just be around the corner.

Lets take a look at our top 8-day trading tips for becoming (and staying) a successful day trader.

1. Cut Out the Emotions

If youre happy and you know it… bring yourself back down.

The emotional key to trading is neutrality. When you come to the trading table, imagine youre doing so like a robot, free from human emotions.

This means that whenever you bring sadness, happiness, anger, joy, frustration, whatever, to your trading day, it will have an impact that is outside the realm of your trading plan and strategy.

If you‘re happy, you might overtrade due to an excess of confidence. If you’re sad, you might sit out trades that should have been made according to your plan. Whatever the emotion is, learn to control it and reduce it to a neutral state in order to think clearly and make level-headed moves in the market.

2. Set your Trading Hours

When youre left to your own devices, it can be a monumental struggle to discipline and schedule yourself into a strict daily routine.

This is why one of the first things you should do as an independent day trader is to set your trading hours.

Just because you can trade at 3 am, doesnt mean you should (unless, of course, that hour is part of your trading plan).

When you set business hours, you give yourself a schedule devoted to your craft, as well as time that can be spent doing out-of-trading activities. It‘s important that you have personal time for family, friends, hobbies so that you don’t burn yourself out with trading 24/7.

3. Accept That Winning Outside Of Your Trading Plan Is Actually Losing

What‘s at the core of every great trader’s arsenal? An airtight trading plan.

For example, you see the market trending upwards, and you get a feeling deep down that there‘s a can’t miss trade just sitting there, waiting for you to make.

But its not in your trading plan.

Screw it. You make the trade anyway. This time it might work out for you but the more and more trades you make based on your gut and not your plan, the closer you come to inevitably losing and losing big.

In this sense, as an inverse to the tip, losing while following your trading plan is actually winning.

4. Pinch Pennies When It Comes To Operating Fees

Anything that might potentially eat into your profit needs to be looked at through an ultra-strong magnifying glass.

While were not advocating using cheap services, just be sure not to spend more than you need in order to function reliably and successfully.

An important tip, not just for day trading, is to keep the fees and costs low so youll have more money to inject into the market.

5. Accept That Risk Management Is The Most Important Thing To Keep Your Eye On

Great entries and great exits are critical to succeeding in the market, but its what we do in between these two events that will make or break us as traders.

This means you need to have a great risk management strategy built into your trading plan. It also means that if the price is approaching your stop level, you follow the rules you set up for yourself and get out.

6. Its Not All About The Benjamins

When you only focus on making money, its easy to let greed take over and lead you to poor decisions.

Yes, we‘re trading to make enough money in order for it to be a career, but when you just focus on the cash, you’ll end up with tunnel vision that often misses the big picture.

Price will move regardless of what you know or what you do. This is why its imperative to focus on and execute your trading plan, not the allure and potential of a windfall.

7. Own Up To Everything

Take full responsibility for everything that happens to you in the market.

Price breaks against your wishes? Tough, it happens. Something else doesnt go your way? Get used to it. The market does whatever it wants.

There are no other factors to point to and blame if things dont work the way you wanted or expected them to work. The only thing you can do is go back, review, and possibly tweak your trading strategy in order to limit the damage in the future.

Everything that you do in the market is all on you. Accepting this is the only way youll be able to change and evolve as you advance in your trading career.

8. Its All In The Trading Plan

This final day trading tip is really a summation of the previous tips combined.

In your trading plan, have defined entries, exits, and risk management strategies and follow your rule book to a T.

A good trading plan will be like your bible, a guiding light through calm times and a life jacket in stormy markets.

Day Trading Tips The Bottum Line

There is no doubt that day trading is very exciting, and it has the potential to make a nice income, and of course, there is no boss on your head.

But like anything else in life, if you do not become a professional, you will not succeed.

Do you want to be a successful day trader? If you do not have a trading plan or risk management, then you are not there yet.

Source:the5ers.com

Leave a Reply