-

Focus on taper talks at todays Fed meeting

-

USD/JPY, USD/CAD, and EUR/USD trade setups

And just like that, it‘s time for another Fed meeting. It seems just like yesterday when we were trying to anticipate Powell’s next move ahead of the June meeting, and to be honest, not much has changed since then. Economic data continues to be heading in the right direction but it is not quite there yet in terms of what the central bank wants to see to start changing monetary policy, at least that is along the lines of what I am expecting from Powell today.

What has changed is the bond market, which is signaling a muted concern about inflation, a big drop from where we were before the previous Fed meeting. With CPI and PPI data still coming in hot, the bond market is suggesting a matureness in expectations where they trust the Fed when it says that price pressures will be transitory. This means that expectations about longer-term inflation are pretty stable, also signaled by the flattening of the yield curve, likely on the back of an expected tightening of monetary conditions later down the line.

A big focus going into the Jackson Hole symposium next month is what type of asset support will be scaled back if tapering is announced. There are high expectations for Mortgage-backed Securities (MBS) to be the first to get the chop, but this is mostly based on speculation given how the property market is running hot. MBS purchases are currently at 40 million dollars per month with the potential of this figure being completely drawn down as soon as next month.

In regards to the announcement, I believe that the base case of no changes to policy will see some positive risk appetite and some possible dollar weakness, which has been getting some support recently on the back of risk-off sentiment, particularly against high-yielding, commodity currencies.

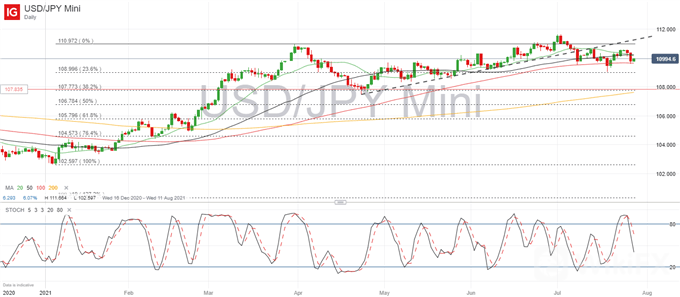

USD/JPY: the pair continues to come down from a 16-month high (111.664) ahead of the Fed meeting as the Japanese Yen was also picking up some bid on the back of the recent risk-off move. Weve seen a modest uptick in bond yields which has helped the US Dollar cement some short-term support +, cementing a resistance at 110.59. A stronger US Dollar post-meeting may see buyers looking for a renewed break above the ascending trendline at 111.22 whilst a bearish reaction is likely to find support at the 23.6% Fibonacci level (108.996).

USD/JPY Daily Chart

USD/CAD: the pair has been able to hold above the descending channel after it was able to hold on to some dip-buying just after the previous Fed meeting. Since then, momentum has been strongly bullish and the pair has been sticking to an ascending trendline support which has propelled it back above the 1.25 line. That said, the pair has stagnated in the last few sessions with some resistance just above the 1.26 line meaning we could see some renewed bearish pressure testing the trendline.

USD/CAD Daily Chart

EUR/USD: after flatlining its recent bearish trend, EUR/USD has a U-shaped recovery underway as buyers have found support across the 1.18 line. The key now will be whether the bullish reversal follows the U-shaped pattern and so we see small daily gains building on each other, or if we see momentum picking up and breaking out into a steeper V-shaped bounce which would see buyers attempting to break 1.19 in the next few days. Alternatively, the pair could settle back into its support range between 1.1738 and 1.1704.

EUR/USD Daily Chart

Leave a Reply