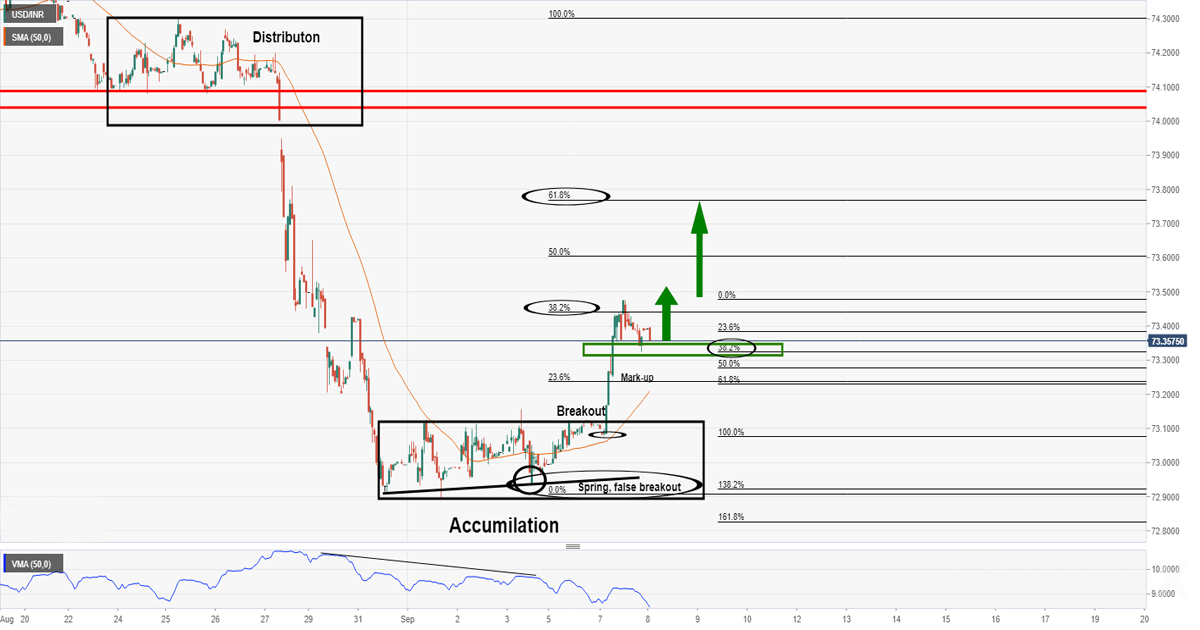

USD/INR Price Analysis: Wyckoff methodology playing out, bulls target 61.8% golden ratio

USD/INR continues in its correction of the prior daily bearish impulse.

USD dollar rallies through the day dynamic resistance trendline.

The Indian Rupee is facing strong resistance from the bulls as the US dollar resurges at the start of this week.

USD/INR has rallied from trendline support and has already completed a 38.2% ratio of the prior daily bearish impulse.

This sets the stage for further advances towards prior support all the ay near the 74 figure as illustrated below.

First, the bulls will need to challenge possible bearish commitments at the 61.8% golden ratio near 73.80.

Meanwhile, from an hourly perspective, the price is already meeting resistance at the 38.2% ratio as follows:

In the above illustration, using the Wyckoff methodology, the price is in a mark-up phase and is likely to head higher following a 38.2% Fibonacci retracement in the first pull-back since the initial breakout.

DXY technical analysis

The price will be especially bid if the DXY bulls can make ground above the dynamic counter-trendline:

Leave a Reply