【Dow Jones】

Friday Data showed that the Personal Consumption Expenditure Price Index (PCE) rose 0.2% month-to-month in April which is in line with expectations.

Dow Jones index went higher once again and formed a W pattern. KD is in a high-end blunt area which indicates strong buying. This wave has changed the death cross of Alligator into an entanglement. The follow-up observation would be whether the KD indicator is out of the high-end blunt area.

USA30-D1

Resistance point 1: 33500 / Resistance point 2: 33800 / Resistance point 3: 34200

Support point 1: 33000 / support point 2: 32800 / support point 3: 32500

【EUR】

According to a recent report from management consultancy Accenture, global supply chains have been disrupted by the COVID-19 pandemic and worsen due to the Russo-Ukrainian war. It estimates that by 2023, the eurozone's gross domestic production (GDP) will lose out by a cumulative €920 billion (US$988 billion).

The Accenture report shows that the supply chain chaos caused by the epidemic led to a €112.7 billion economic loss in the euro area last year. If the Russo-Ukrainian war is protracted and supply chain problems are exacerbated, it forecasts another eurozone GDP loss of another €318 billion this year and 602 billion euros next year.

EURUSD rose mainly because of the decline of the US dollar. KD is now in the high-end blunt. Coupled with the current Alligator which shows a golden cross, the euro is forecasted to follow this bullish trend.

EURUSD-D1

Resistance point 1: 1.07800 / Resistance point 2: 1.08200 / Resistance point 3: 1.08500

Support 1: 1.07000 / Support 2: 1.06800 / Support 3: 1.06500

【Gold】

Gold prices were supported by the decline in the US dollar and US Treasury yields which kept gold above the 200-day moving average (about $1,842 an ounce). It is believed that the room for further growth in gold remains limited mainly due to the impact of the rebound in the stock market. The rebound boosted investors' risk appetite and made gold's safe-haven attractiveness less.

Gold rebounded from $1800 an ounce and was pulled up to the $1850 region. KD is still in a death cross, while the long-term Alligator also shows a death cross which indicates that the recent bearish strength before the pull-up is still the main trend.

XAUUSD-D1

Resistance point 1: 1870.00 / Resistance point 2: 1880.00 / Resistance point 3: 1900.00

Support 1: 1840.00 / Support 2: 1820.00 / Support 3: 1800.00

【Crude Oil】

Iraq's oil minister, Ihsan Ismaael, said on May 28 that the country plans to increase crude oil production capacity to 5 million barrels per day by 2025 and 8 million barrels per day by 2028, as compared to the country's current crude oil production capacity of 4.8 million barrels per day. Official Iraqi data showed that in April 2022, the country's crude oil production was 4.43 million barrels per day which is a two-year high.

Iraq is trying to attract capital and investment from international oil companies in the hope of increasing the country's crude oil production capacity. However, due to the country's political instability, investment climate, and international trends in energy conversion, the Iraqi National Oil Company was limited its capacity growth due to political instability and lack of efficiency.

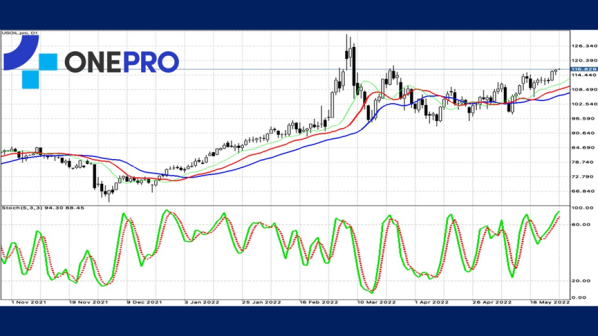

Crude oil has broken the previous wave highs. Alligator shows a golden cross, while the KD shows a high-end figure which indicates that the buying strength is currently strong. If the resistance of 118.58 is broken through, there is a chance it will challenge the next resistance point.

USOIL-D1

Resistance point 1: 117.800 / Resistance point 2: 119.500 / Resistance point 3: 121.200

Support 1: 115.500 / Support 2: 113.200 / Support 3: 111.800

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs at www.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply