【Dow Jones】

The Labor Department of the United States announced that the CPI rose by 9.1% in June, higher than the market's expected 8.8% and the previous value of 8.6%. The volatile core CPI, excluding energy and food, rose by 5.9% a year, also higher than the market's expected 5.7%, but lower than the previous 6%.

In the daily technical indicators of the Dow Jones index, the long-term Alligator, short-term, the long-term and short-term technical indicators KD show a dead cross, so the chance of challenging the low point is quite high.

USA30: Downtrend

Price Point:31502

Current Transactions: hold empty orders with targets at 30500 and 30200

Option: Set 31800 and 32000 as targets after the price breached above 31502.

Comment: The RSI value of 41.38% is on the short side.

【Euro】

The euro fell below parity against the dollar on Wednesday (13th) for the first time in nearly 20 years due to the hawkish stance of the Federal Reserve and concerns about the rising risk of a recession in the eurozone.

In the pace of economic recovery after the epidemic, the European single currency has performed strongly this year. But Russia's invasion of Ukraine, soaring gas prices in Europe and fears that Russia could cut supplies further have exacerbated expectations of a recession and hurt the euro.

In the daily technical indicators of the Dow Jones index, the long-term Alligator is dead and crossed, and the short-term KD is low and passive. The long-term and short-term technical indicators are both empty. In addition, the index continues to fall below the band low, so it is not recommended to trade against the trend in the short term.

EURUSD: Downtrend

PricePoint:1.01800

Current transactions: hold empty orders with targets at 1.00000 and 0.99800

Option: Set 1.02000 and 1.02200 as targets after the price breached above 1.01800.

Comment: The RSI value of 24.3% is on the short side.

【Gold]】

Gold holdings in SPDR Gold Shares (GLD), the world's largest gold ETF, fell 1.74 tonnes to 907.879 tonnes on the 13th, a five-month low.

U.S. Labor Department released data on the 13th, showing that the U.S. consumer price index (CPI) rose 9.1% a year in June, once again setting a 40-year high.

In response, U.S. President Biden said that although the CPI data is “unacceptably high,” it is also “outdated,” saying that nearly half of the monthly CPI increase is due to energy prices, while the impact of the continued decline in U.S. retail gasoline prices over the past month is not fully reflected, and the core inflation rate has fallen below 6% for the third consecutive month.

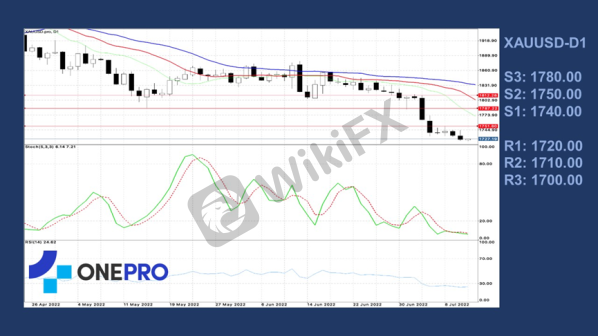

In the technical indicators of gold's daily line, the long-term Alligator has shown a dead cross, but the short-term KD has begun to show a gold cross, indicating that the short-term buying has begun to support, but the long-term pressure is still heavy, and the rise should not be expected too far.

XAUUSD: Downtrend

PricePoint:1751

Current Transaction: Empty Orders Held, Targets 1722 and 1717

Option: Set 1758.00 and 1762.00 as targets after the price breached above 1751.

Comment: The RSI value of 26.94% is on the short side.

【Crude Oil】

As a result of the strong US dollar, the continued suppression of commodity prices and the intensification of worries about the global economic slowdown, the international oil price plunged sharply. Brent and WTI crude oil futures both fell by more than 6%, Brent crude oil fell below the US$ 100 mark, and WTI crude oil fell to US$ 97, both hitting a three-month low.

Dennis Kissler, BOK Financial's senior vice president in charge of transactions, said that oil prices are under great pressure because consumer sentiment is still low and China's epidemic is on the rise.

Among the daily technical indicators of crude oil, the long-term Alligator shows death cross and the short-term KD also shows death cross. The long-term and short-term technical indicators are both death cross, and the chances of continuous decline are quite high.

USOIL: Downtrend

Price Point:105.83

Current transactions: hold empty orders with targets at 94.8 and 93.5

Alternative: Set 106.20 and 106.80 as targets after the price breached above 105.83.

Comment: The RSI value of 34.32% is on the short side.。

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs at www.oneproglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply