Coming across to the newly established brokerage always makes traders doubt their legitimacy since there are a lot of scAM Brokerages appearing on the trading market since it is very lucrative. Hence, when a trader is considering opening an account with a new broker, he or she needs to examine it very closely. One such brokerage is AM Broker, established in 2018. The broker is registered in Saint Vincent and The Grenadines and is registered by the local regulator. It might raise the question is AM Broker legit or a scam company since it is registered offshore? This review will go into the details of the brokerage to see if it can be trusted or not.

AM Forex broker offers its service to different types of traders including retail traders, professionals, and even institutional ones. It means that the broker should have a very diverse service and offerings to the traders. The broker does offer diverse trading instruments from six asset classes and several trading platforms. The minimum deposit requirement is 1000 USD, after opening an account with the broker, traders have the possibility to trade pairs with the spread of 0.6 and use leverage up to 1:500.

First impressions

One of the ways of how to know if a broker is legit is to check the website and see if any of the information is missing there or is dubious. AM Broker FX Brokerage website leaves a very nice first impression. Once you visit the website you can see with one glance that it is very welcoming. The design of the website is very nice, technically it works without any flaws and navigation is also very easy. Seemingly, the broker has invested enough to make a good website that serves traders well. The content on the website is decent as well. Any kind of information is easily accessible on the website. Traders are able to find answers to all their questions and be fully equipped with information about trading conditions. Hence, from a glance at the website of the broker, everything seems to be legit.

AM Broker review of trading instruments

Before opening an account with the broker you need to know what the trading is like with the brokerage. AM Broker offers a wide selection of trading assets. Making it possible for traders to find the instrument they want to choose from and make their trading portfolio diverse.

The broker offers up to 100 currency pairs that consist of major, minor and exotic cryptocurrencies. The page dedicated to the Forex instrument shows some of the currency pairs you can trade with alongside their bid/ask price and spread. Traders have the possibility to use leverage up to 1:500 when trading Forex. Which we should admit is a bit risky when it comes to first-timers or less experienced traders in Forex.

Another popular instrument to trade with AM Broker FX brokerage is CFD on indices, the broker offers some of the most popular indexes such as SP500, DAX30, DJI30, and more. In total, there are 20 indices available for trading with 1:500 leverage. The broker offers over 3000 CFDs on stocks from 15 stock exchanges, the list includes stocks of Facebook, Apple, Amazon, and many other big companies. The maximum leverage allowed for CFDs on stocks is 1:20. The broker also offers CFDs on Exchange Traded Funds (ETFs). Traders have access to 300 ETFs from 15 stock exchanges and can trade with them with the leverage of 1:20.

For those, who are interested in more modern trading instruments the broker offers CFDs on cryptocurrencies. Yet AM Forex Broker offers top cryptocurrencies only such as Bitcoin, Bitcoin Cash, Ethereum, Ripple, and Litecoin. Traders can use 1:5 leverage for trading CFDs on cryptocurrencies.

Last but not least, the broker also offers CFDs on the most popular commodities such as precious metals – gold and silver, one can also trade with CFDs on brent, oil, and gas. The maximum leverage for these trading instruments is 1:500, which is again maybe too much for the beginners.

The diversity of the trading instruments is one of the reasons behind the positive impressions. However, the question of is AM broker regulated should be considered when exploring the opportunities that the broker is offering. The broker holds no regulation of the recognized regulatory body and is only registered locally in the Caribbean. Moreover, when we look at the high leverage offered by the broker, we should highlight the risks associated with it. Traders, especially well-experienced ones can enjoy high leverage and increase their profits. However, beginner traders should be aware of the risks and be careful with the full potential of the leverage.

Account types

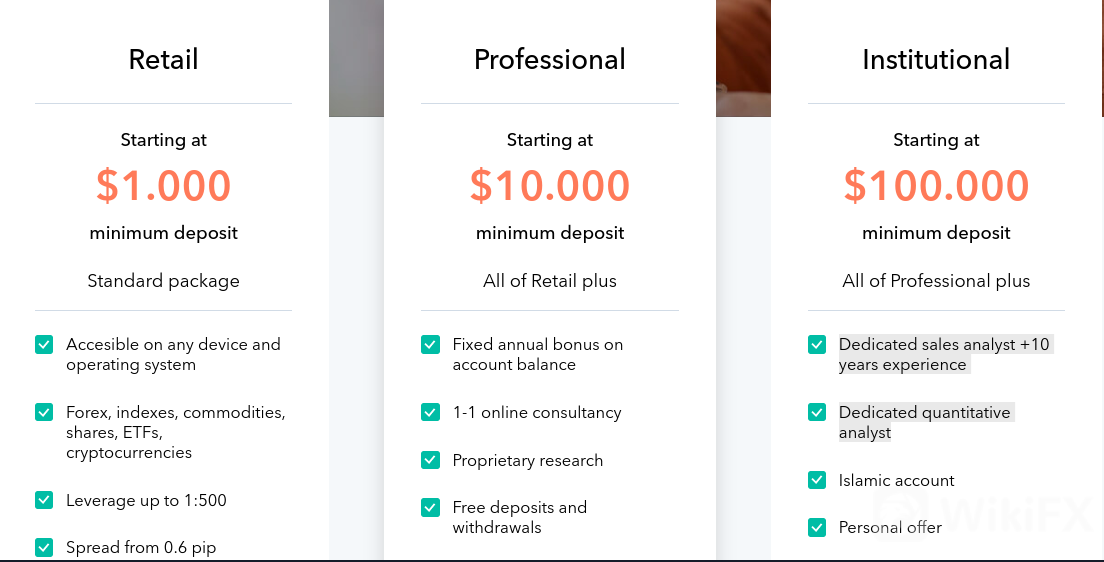

There are three types of accounts offered by the broker. The account types are for retail, professional and Institutional brokers. It would be nicer if retail traders would have more choices for the accounts based on their trading needs and experience. However, the accounts and features are not designed badly.

The retail account is a standard account and AM broker minimum deposit for this account starts from 1000 USD. The minimum deposit requirement is much higher than the average brokers offer worldwide, leaving an impression that the broker targets more experienced traders rather than absolute beginners. The standard account comes with some features such as a personal relationship manager and integrated online support. The professional account starts from 10.000 USD, and the institutional account has the minimum deposit requirement of 100.000 USD. You can check the features of these accounts below.

AM Broker withdrawal and payment methods

When dealing with international brokerage, it is very important to have several payment methods available, so that you can choose the one that works best for you. AM Brokers offers some of the most popular payment methods available today. You can use traditional credit/debit card payment with VISA and MasterCard or use electronic payment methods such as Neteller, FastPay, and Skrill for depositing your account or making a withdrawal. The minimum deposit or withdrawal amount for the retail and professional clients is 100 USD only, for the institutional clients the amount is 1000 USD, which is again much higher than most of the international brokers would offer and maybe not that much convenient for the traders.

Can AM Broker be trusted?

The main question to be answered is if the AM broker scam or not. There are no signs that the mentioned broker is a fraud, however, being a legit broker does not mean its 100% reliable. The website, content placed there, and the description of the trading conditions suggest that the broker is transparent and legit. Another question is if you should trade with the broker or not. The only concern that we have is that the brokerage firm is based and licensed in Saint Vincent, however, most of it targets clients from Asia and Africa. The broker has no regulation or license in these following regions, therefore, we would not recommend trading with the broker for African and Asian clients. The broker can be trusted in those regions wherever is AM broker regulated,so in the Caribbean.

For Asian and African traders, we would strongly recommend XM Forex broker instead, which is an international broker regulated by multiple authorities and having a strong reputation over quite some time.

Leave a Reply