As a trader, you‘ll have access to all or some of these venues, depending on the services provided by your broker. In addition, let’s introduce the three types of trading styles you can choose, depending on your account size, willingness to watch the forex market in ‘real-time’, and long-term goals.

KEY POINTS

Currencies can be traded through spot, forwards, and futures markets.

Forex traders can take positions lasting from a few seconds to a few months or years.

The majority of forex trading strategies follow the trend, higher or lower.

Trends and counter-trends can be subdivided into much longer and shorter time frames.

Charles Dows work on trends more than 100 years ago is still used every day by forex traders.

Spot Market and the Forwards & Futures Markets

Market participants can take risks in three types of forex markets: spot market, forwards market, and futures market:

Spot Market: the most popular of the three, with traders worldwide exchanging ‘real assets’ through an electronic communications network, broker dealing desk, contracts for difference, or direct interbank system. Prices on the spot market are based on supply and demand.

Forwards Market: a more sophisticated venue, accessed by international companies and large investors seeking to hedge currency risk. For example, McDonalds might enter into forwards contracts to lower the risk of exchange rate fluctuations and price shocks in other parts of the world. The parties to a forwards contract choose agreed-upon pricing, which can differ greatly from interbank or futures quotes.

-

Futures Market: the most popular forex venue prior to the advent of retail forex brokers. Futures contracts are based upon a standard size and settlement dates on the Chicago Mercantile Exchange (CME) in the United States and regulated by the National Futures Association. Smaller exchanges in other countries also offer currency futures contracts. Minimum price increments, delivery, and settlement dates are determined by the contract and the exchange is the counter-party in all cases.

Different Trading Styles

The majority of retail forex traders follow one or more of three main strategies and methodologies:

-

Day trading

-

Scalping

-

Swing (position) trading

Day trading and scalping are two of the most aggressive and active trading styles. In both cases, positions will be closed before the end of the active session. However, these styles differ in trade frequency and holding period.

Scalping techniques take advantage of very small movements, often buying and selling within a few seconds or minutes. Scalpers analyze very short-term charts, looking at 1-minute to 5-minute price action for clues to directional impulses. High transaction costs eat up returns with this high volume trading strategy, requiring a high win-to-loss ratio to book consistent profits.

Day trading techniques focus exposure on 5-minute to hourly charts, looking for directional impulses lasting from one to six hours, as a general rule. Occasionally, day traders will ‘take-home’ a position, holding it overnight while seeking greater profits or an important move at the start of the next session.

Swing trading techniques are longer-term, with positions held for days or weeks. A sizable minority of swing traders also review long-term signals and hold positions for several months. The chosen method determines which price charts to follow, looking for buying or selling signals on hourly, daily, and even weekly charts.

Forex traders use different types of entry and exit orders, depending on their trading styles. For example, scalpers use market orders more often than swing traders because it lets them enter or exit positions instantly. Limit orders are more useful for day traders and swing traders because positions can be taken at pre-determined prices. In addition, it‘s important to use stops on all, day and swing trades to limit losses, in case the market decides you’re wrong.

The Importance of the Trend in Forex Trading

Forex traders follow interest rates and the world economy but most rely on technical analysis to evaluate major trends and make trading decisions. This classic approach depends upon three basic assumptions:

-

Prices discount everything.

-

History tends to repeat itself.

-

Prices move in trends.

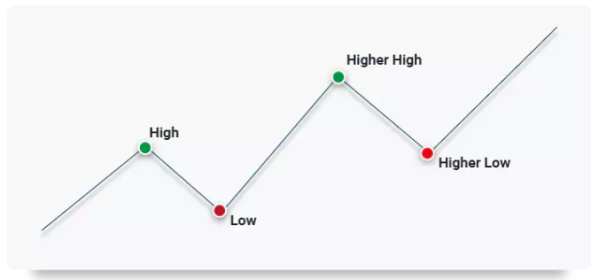

The majority of newcomers think prices only go up or down but Dow Theory asserts there are actually three trends in the market: up, down, and ‘sideways’ or rangebound. According to Charles Dow‘s work, 100 years ago, investors and traders need to look at the sequence of highs and lows to determine a trend’s long and short-term direction.

Specifically, his theory states an uptrend is generated by higher highs and higher lows while a downtrend is generated by lower highs and lower lows. In addition, when neither buyers nor sellers have control of the market, prices evolve within a lateral consolidation, also called a ‘trading range’.

The theory categorizes relationships between trends in different time frames, which may converge with each other or diverge from each other. According to Dow, each trend is formed by three other trends: ‘primary’, ‘secondary’, and ‘minor’.

A primary trend lasts more than a year and signals a bull or bear market. Within a primary trend, a secondary trend goes in the other direction, carving a pullback lasting between three weeks and three months. Finally, minor price action is common within the secondary trend, lasting less than 3 weeks.

Traders and technicians have refined Dow‘s brilliant trend observations over the last century. We now understand, in our fast-moving modern electronic markets, that primary, secondary, and minor trends can evolve over days or weeks, rather than months or years. Even scalpers apply Dow’s work when flipping positions in the 21st century, using 1-minute to 5-minute charts to determine the primary trend.

Summary

Market participants can take forex exposure through a variety of cash and derivatives markets but most trade in a cash market through a forex or contracts-for-difference broker. Most forex traders speculate on currency prices through time-based trend-following strategies that include scalping, day trading, swing trading, and long-term investment. The majority of forex trading falls in-between these extremes, with positions open for a few hours to a few days.

Leave a Reply