Ethereum price rallied ahead of the London hard fork as investors hope that Ether would become a deflationary asset, and the upgrade would solve the issue of high gas fees.

The latest upgrade to the Ethereum blockchain introduced five new Ethereum Improvement Proposals, including EIP-1559, which aims to improve the networks user experience and value proposition.

EIP-1559 changed the way transactions are processed on the blockchain and puts forward an algorithm that automatically sets the price of gas.

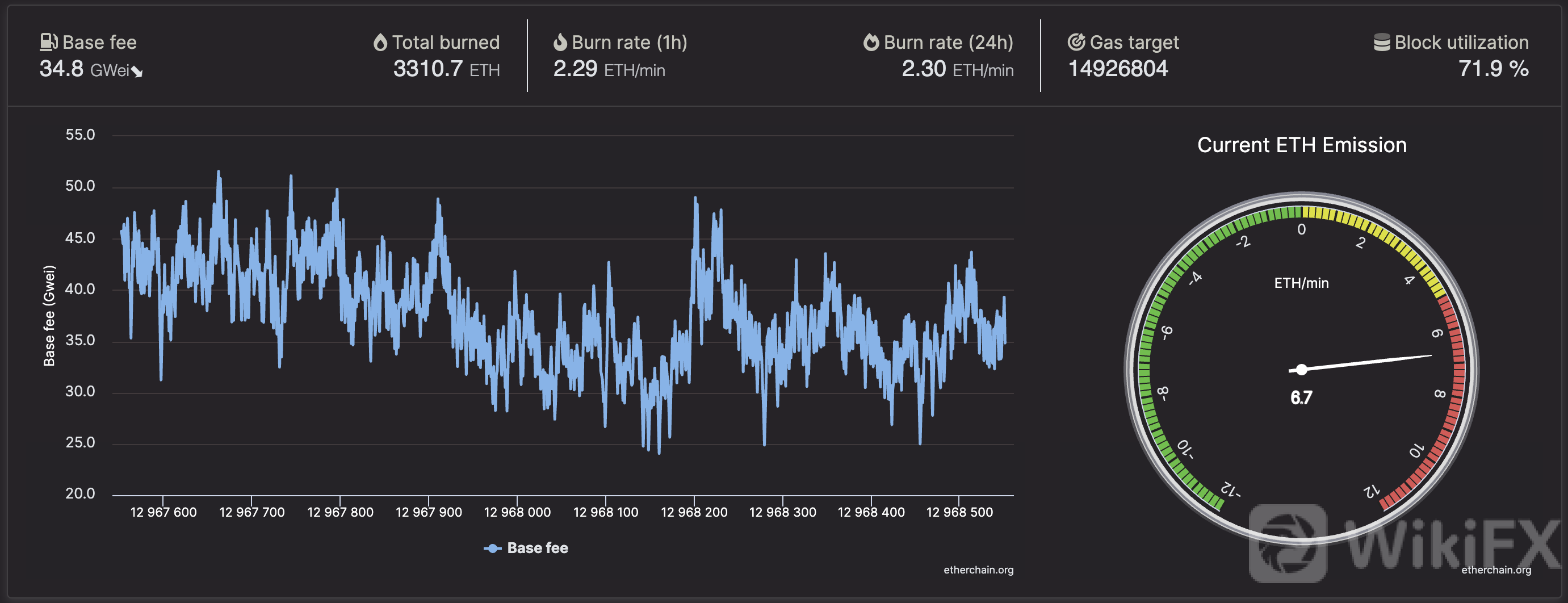

The upgrade also involves a burning mechanism, which destroys a portion of Ether – that could introduce some deflationary pressure on ETH.

However, only under the condition that the burned fees exceed the issuance of new Ether would only see ETH becoming a deflationary asset. Nic Carter, Castle Island Ventures, added that this would only occur “at times of extreme fee intensity.”

While EIP-1559 comes with benefits, including reduced transaction costs and relieving network congestion, miners were put at a disadvantage with lower mining rewards.

Miners would not be able to receive the same amount of income they made prior to the London hard fork. However, Matt Hougan, the chief investment officer at Bitwise Asset Management, explained that due to the fact that miners are organically linked to the overall value of Ether, they could make of for these losses if Ethereum price rises owing to the protocol changes.

Less than 12 hours following the London upgrade, over 3,000 ETH have been burned, which is worth over $8 million in value. At the time of writing, over 3,310 Ether has been burned, equating to over $9 million in value.

Ethereum co-founder Vitalik Buterin added that the London hard fork makes him “more confident about the merge” to ETH 2.0 that is expected by early 2022.

Leave a Reply