Crude oil is trading at a steep discount versus Brent crude oil, driving US exports

EIA data in focus as traders assess global oil flows amid Russia-Ukraine conflict

A large US inventory draw may see WTI prices rise faster relative to Brent prices

Brent and WTI crude oil prices are moving lower in Wednesdays Asia-Pacific session. A renewed sense of hope about a cease-fire agreement between Ukraine and Russia may be helping to cool prices. Earlier this week, oil prices sank more than 8% as China announced a two-stage lockdown in Shanghai, a major Asian finance hub.

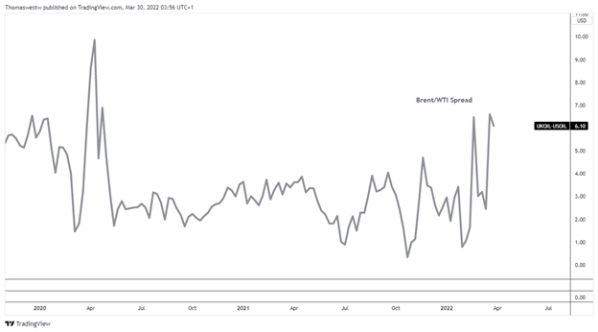

The economic sanctions levied on Russia have thrown energy markets into disarray recently. The global benchmark, Brent oil, has outpaced the rise in WTI crude prices, the US benchmark. That is likely explained by the fact that Russias supply is more influential on Brent, given the geographic nature of the global oil market. The US prices are inherently more insulated from Russian flows being cut off, as Canada, the United States, and Mexico are all substantial producers.

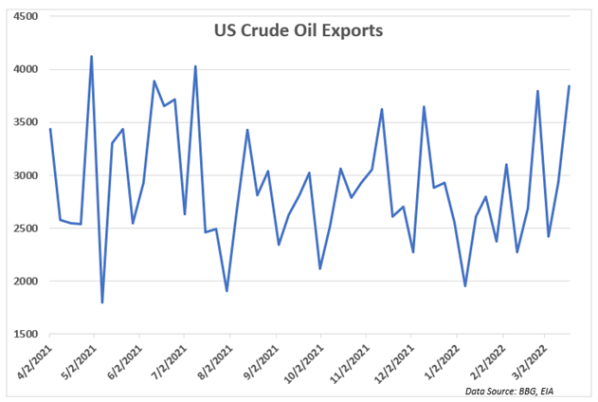

However, the difference in price movements resulting from those factors has pushed Brent prices to trade at the highest premium versus WTI prices since May 2020. That discount is encouraging a preference for buyers to source US oil, evidenced by a recent uptick in exports from the United States, according to data from the Energy Information Administration (EIA). In fact, exports hit the highest level since July 2021 for the week ending March 18 (see chart below).

Tonight, the EIA will report updated information on inventory and exports for the week ending March 25. The data will spread further light on the global energy situation. If the increase in exports continues, that could lead to a larger-than-expected draw in inventory levels. If so, that could shrink WTIs discount over Brent prices. Analysts see crude oil stocks decreasing by just over 1 million barrels. Moreover, the ongoing situation in Ukraine and the Covid outbreak in China may have a larger impact on broader price direction.

Leave a Reply