WHEN DOES FACEBOOK REPORT EARNINGS?

Facebook is set to release its Q3 financial results on 25 October, after the market closes. At the time of writing, expectations are pointing to a 32.1% increase in earnings per share to US$3.17, up from US$2.40 a year ago.

FACEBOOK EARNINGS – WHAT TO EXPECT

For the upcoming earnings release, the impact of Apple‘s anti-tracking initiative on Facebook’s businesses will be closely assessed, as the management has previously cautioned of a larger impact of the iOS updates in Q3, compared to the previous quarter. To recall, Apple has previously implemented new privacy controls, which limit digital advertisers from tracking iPhone users for advertising purposes without their consent.

While the dropout rate to allow data collection remains to be seen, the upcoming Q3 results may provide some clarity on the impact to Facebook ad effectiveness and switching from advertisers. Some resilience in the figures for average price per ad and number of ads delivered may aid to ease some concerns in that regard.

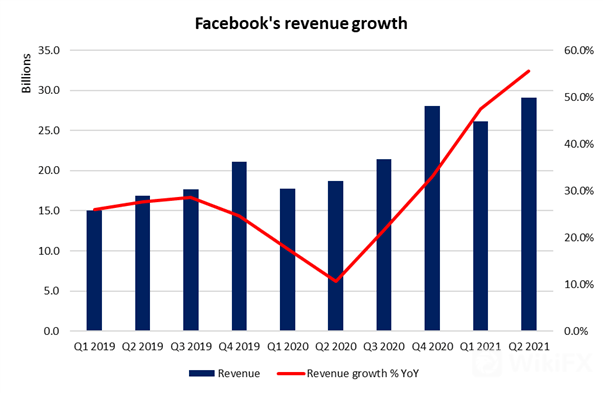

The upcoming earnings into 2H 2021 may also reveal a lower base effect compared to a year ago, where Facebook saw a huge boost in sales in 3Q and 4Q 2020 from a strong recovery in business advertising spends. Sales and earnings growth may continue to normalise in the quarters ahead and the managements outlook will be looked upon for guidance.

Facebook has also been weighed by recent negative news flow, coming from a whistle-blower on the harmful effects of Instagram for young users. The management may need to address these concerns and while debates around the issue may drag on towards year-end, subsequent platform and businesses‘ processes adjustments by Facebook may ease such concerns in time to come. This may be reflected in previous instances of data breaches, where markets look past these near-term ’noises‘ and daily active users for Facebook’s ‘family’ of products continue to grow.

A risk for Facebook share price, however, may be movement in the US 10-year Treasury yield. With 10-year yield having broken out of its period of consolidation since late September, further upside may be a likely scenario, which could keep valuation multiples of high-growth companies in check.

FACEBOOK SHARES – TECHNICAL ANALYSIS

Ever since its 50-day moving average (MA) failed to hold up prices back in mid-September, Facebooks share price has been trading within a near-term descending channel. That said, while prices continue to trend downwards, the relative strength index did not reflect a lower low lately, suggesting that downward momentum may potentially see some easing. A retest of the 200-day MA was met with a bullish hammer candlestick, which will remain a key support MA line to watch. That may potentially lift prices to retest the near-term resistance at US$337.00, where the level has held down prices on previous three occasions.

Leave a Reply