The US dollar had shown some weakness last week despite the imminent decisions on Tapering. Investors seemed to have forsaken dollar and continued investment in the risky assets including gold and stocks. However with very many Economic data on inflation to come from New Zealand, UK, Canada, and Japan, as well as global Flash PMIs. It is likely that the US dollar will further loose dominance while investors would continue with these risky assets including gold. EURUSD will benefit greatly from this week's Economic reports to ascend from the current support. Crude Oil is currently overbought and may retrace from the current resistance at $82 due to the gradual restoration of Economic activities across the globe.

US dollar depreciates despite imminent tapering.

The US dollar dominance since the month of September had significantly depreciated last week. Despite the imminent November tapering, investors seemed to have neglected it and continued buying higher into stocks, Crypto and other assets. However, there is a greater concern that the US dollar might fall more this new week with Inflation data due out from New Zealand, UK, Canada, and Japan, as well as global Flash PMIs. There will also be a data dump on Monday from China.

Equally there are other economic events to be released this week that may restrict the US dollar dominance such as the Inflation data to released from New Zealand, Germany, Eurozone, Canada, and Japan. The critical consideration here is: Will higher inflation continue to push funds into risky assets, or will traders fear central bank tapering and cut back on risk? In addition, China releases Q3 GDP, Industrial Production, Retail Sales and the Unemployment Rate for September. Traders will watch to see if evidence of a China slowdown continues. This will likely push investors to continue investment on the risky assets while forsaking the US dollar to fall lower this new week.

Fundamental Analysis and Forecast for EURUSD

EURUSD is currently staging a positive recovery after a prolonged fall for the past months since July. The market price for Euro had created a strong support at its All time low at 1.151401. The Bulls are currently jumping in to push the price to a higher region. Euro may likely benefit positively from the remarks by the European Central Bank President Christine Lagarde who spoke on Saturday at an International Monetary Fund event. Largarde had hinted that “inflation is largely transitory” and hence, “ECB is committed to preserving favourable financing conditions for all sectors of the economy over the pandemic period.” Optimistically she asserted that “once the pandemic emergency comes to an end — which is drawing closer — our forward guidance on rates as well as asset purchases will ensure that monetary policy remains supportive of the timely attainment of our target.” We therefore expect a positive recovery from EURUSD in the coming weeks. The next target for EURUSD is the resistance at 1.18785

Fundamental Analysis and Forecast for Gold.

Gold had surrendered a portion of its gains last week after daily retail traders took profits ahead of the weekend. The precious metal is currently seating on a new support awaiting the next Upward movement.

It is expected that Gold prices would sower higher this new week especially as global economic growth prospects dim all the more. Investors are currently turning towards assets despite the imminent tapering especially as the demand for Gold keeps increasing ahead of the festive season. We hope to see gold retest the previous all time high last week at 1776 and even higher this new week.

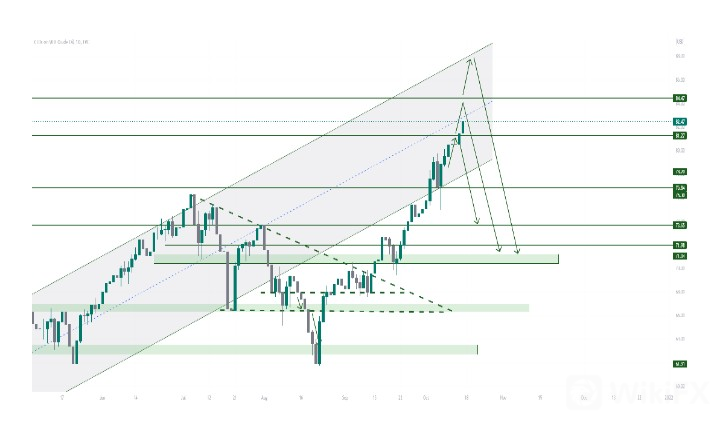

Fundamental Analysis for Crude Oil: Will the Bullish trend continue?

Crude oil has maintained a straight line Bullish run up to $82 from the previous resistance at $62 on August 23.

This is no doubt, the eighth straight week of gains in crude and the highest close since 2014. Despite the fact that the US inventory report this week was bearish yet crude remained unaffected. However, Crude Oil is facing a strong resistance currently and we might see some retracement in the new week due to the revival of Economic activities following a steady recovery from the pandemic.

Leave a Reply