WikiFX Score is comprehensively evaluated by WikiFX based on a variety of factors including the licensed index, the level of business comprehensiveness, the risk control index, the management index, and software parameters. So based on those factors, what are the brokers with the highest ratings this June?

WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

| The Scoring Criteria of Brokers on WikiFX |

| License index: reliability and value of licenses |

| Regulatory index: license regulatory strength |

| Business index: enterprise stability and operational capability |

| Software index: trading platform, instruments, etc |

| Risk Management index: the degree of asset security |

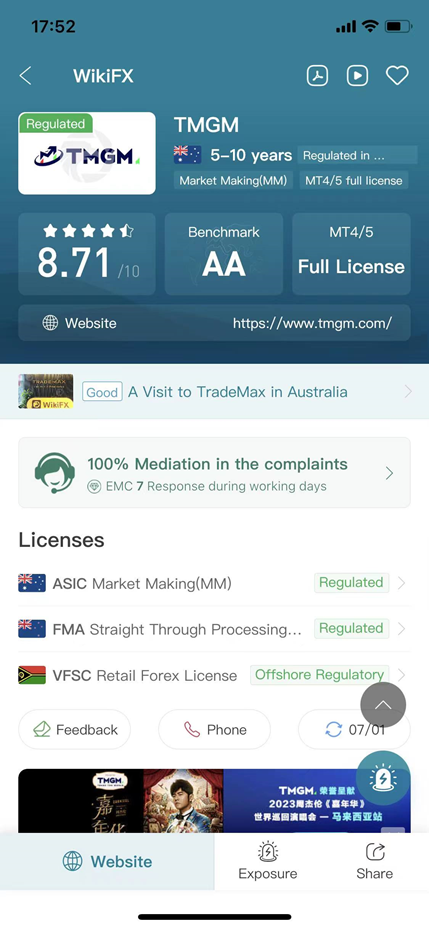

TMGM

TMGM is currently rated at 8.71/10, ranking 5th in the ranking of the highest scoring brokers in June. TMGM's software spec score is almost absolute: 9.99 points. This software parameter is checked by WikiFX data engineer according to the move and technical evaluation of more than 20 indicators such as genuineness, software security, stability, command execution speed,… Specifically, the average transaction speed of TMGM is 440.5 milliseconds, which is rated “Good”. The average slippage is 0.2, which is rated “Very good”. The software disconnection time is 0.4 times per day, rated “Perfect”…

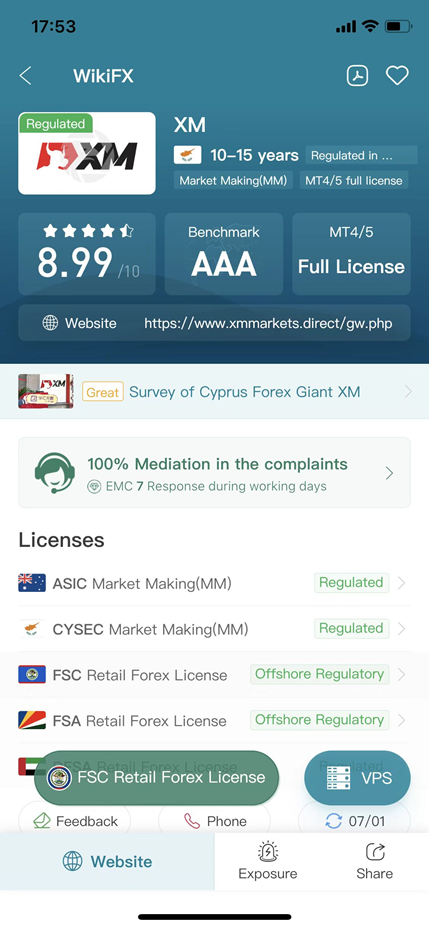

XM

Ranked 4th in the top of the highest-rated brokers in June is XM. The rating of the XM is quite uniform, in which the licensed index is quite noticeable with 9.06 points. This is understandable only that XM is currently managed by the most prestigious institutions such as Belize's International Financial Services Commission (Regulation No. 000261/106), Cyprus Securities and Exchange Commission (Regulation No. 120/10), Seychelles Financial Services Authority (Regulation No. D010), The Australian Securities and Investments Commission (Regulation No. 443670) and the Dubai Financial Services Authority (Regulation F003484). Currently, XM also appears in the top 5 of the rankings on WikiFX. XM is offering free VPS plan support on the WikiFX app. You can download the WikiFX APP to explore more.

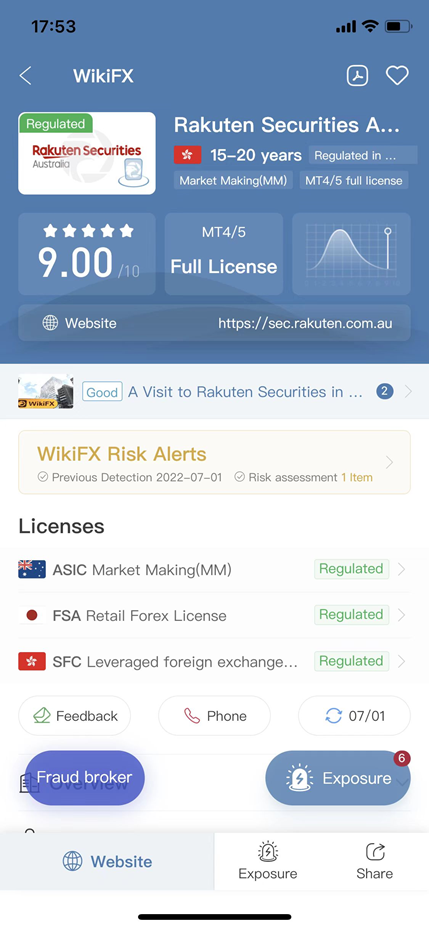

Rakuten Securities

Rakuten Securities is one of Japan's largest forex brokers and is currently ranked 3rd. WikiFX gives Rakuten Securities a rating of 9.00/10. However, in the last 3 months, WikiFX has received 6 complaints about Rakuten Securities and the complaints are all from China. This caused this broker's rating to drop slightly but still gained a high position on the ranking.

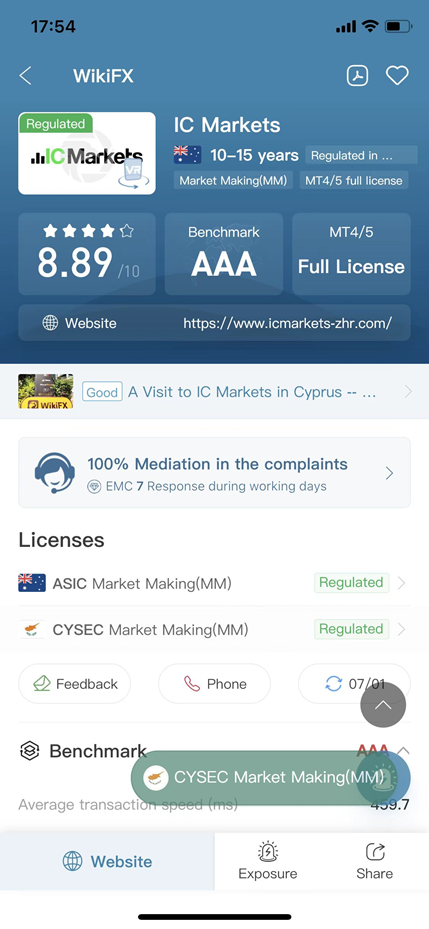

IC Markets

IC Markets has been given a rating of 8.89/10. It is no surprise that IC Markets is highly regarded for its level of credibility. IC Market also provides customers with the best trading conditions, constantly innovating technology, providing the lowest possible spreads, fast order execution speed, and the best customer service… It is also the broker that ranked 2nd.

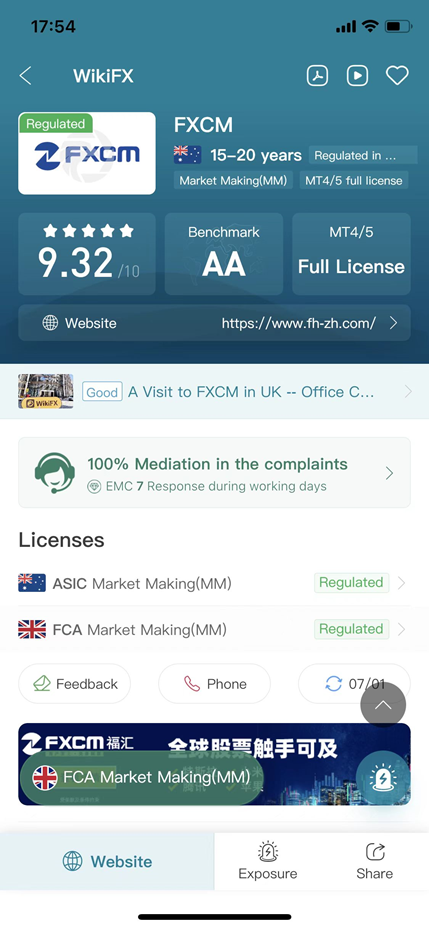

FXCM

The broker with the highest June rating on the WikiFX app is FXCM. FXCM is currently fully licensed by the Australian Securities and Investments Commission (ASIC) and is fully licensed by the Financial Conduct Authority (FCA) in the United Kingdom. FXCM is currently regulated by tire ones two global regulatory bodies – the Australian Securities and Investments Commission and the UK Financial Conduct Authority.

This broker's average rating is 9.32 of which all indicators have a score of 9 or higher: license index 9.16 points, trading 9.05 points, risk control 9.91 points, management 9.13 points, software parameters 9.75 points.

(Note: Because different regions or countries have different levels of regulatory strictness, the score of the same broker might be slightly varied in other regions or countries. For details, please consult WikiFX customer service.)

Leave a Reply