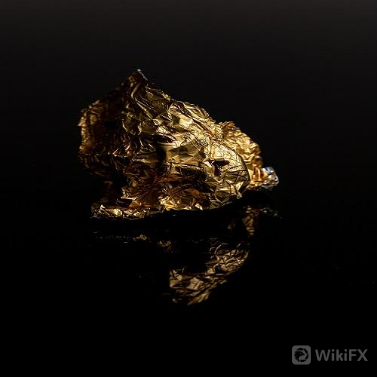

Gold, the most valuable asset in the world, is set to increase in value as inflation continues to rise. Gold is a stable asset that investors deem trustworthy to hedge against inflation.

The value of the U.S. dollar has been crashing since the pandemic, and this has made the FED launch Quantitative Easing (QE) to support the economy. QE is an unconventional monetary policy in which a central bank purchases government securities or other securities from the market to lower interest rates and increase the money supply.

The FED's purchases created an enormous demand for corporate debt, allowing companies to issue new bonds to raise capital. These actions increased the FED's balance sheet from $4.7 trillion on March 17, 2020, to over $7.6 trillion by March 17, 2021. The Fed's balance sheet at the moment is now at $8.1 trillion as of June 2021. The FEDs have nearly doubled the balance sheet in less than two years, and the interest rate is now at 0%-0.25%, its lowest since December 2008.

Bonds and securities purchases have created a surge in the global market, as stock prices climb to their all-time highs and housing markets on the high side as well. Oil, which is an essential commodity, has also soared higher, reaching its highest price in three years. The S&P 500 is also at its all-time high.

The price of cryptocurrencies is also at all-time highs at the moment, but gold and other metals are far behind.

The global market is now longing for a reset as the year comes to an end. Stock prices are too high, the housing market is too expensive (amid the China Evergrande insolvency), crypto prices are flying and commodities are also soaring.

Investors must be looking to balance their portfolio by booking their profits in all these assets to purchase other low-value assets. And Gold is the next asset to turn to at the moment.

Recently, the FEDs announced their plan to stop buying bonds and securities by November, and start increasing interest rates by 2022.

However, global gold production fell by 1% in 2019, its first decline in a decade, according to the World Gold Council, which promotes the gold industry. This created a surge in the price of Gold in 2020, which analysts referred to as “peak Gold” – which means that the maximum rate of extraction has passed and the production of gold will continue to fall until, eventually, mining for it shall cease entirely. But the demand for precious metals shows no sign of slowing down.

And according to CFRA (Center for Financial Research and Analysis), about half of the worlds gold, excluding that still buried in the ground, is used in jewelry. As for the other half, one quarter is held by central banks and a final quarter is owned by private investors or used in industry.

But the pandemic caused a lot of disruption to gold mining operations and supply is not likely to bounce to meet rising demand any time soon. And as such, gold mining industries are sitting on the makings of a major crisis. Coupled with the increase in the price of oil, this will beget an increase in mining operational costs.

“My view is that gold demand will continue to trend upwards. More and more of that is going to come from the recycling, which basically means that gold is trading hands,” says Matt Miller, vice president of equity research at CFRA Research, an investment analysis company.

“CFRA‘s data suggests that around 30% of the world’s gold supply in the past 20 years was actually recycled, not mined. Refineries that recycle ”scrap“ gold – old jewelry, coins, and bars – do use toxic chemicals and energy in their processes, but some environmental impacts may be much lower than mining. One recent study of gold refineries in Germany found that, kilogram for kilogram, the production of 99.99% pure gold via recycling was 300 times less carbon-intensive than mining it from underground or open-pit mines.” BBC Future

“This means that obtaining one kilogram of recycled gold would produce 53kg of CO2 equivalent – but to mine, a kilogram of the same material would cause 16 tonnes of CO2 equivalent to be emitted. Recycling scrap gold from electronics fell in between the two but was still better than mining – at one tonne of CO2 equivalent for every kilogram of gold turned out.” BBC Future

This and other environmental effects have become a barrier to gold production. The case of the Pascua-Lama mine in Chile can be taken, for instance. The project was halted by regulators, after years of protests from the local activists on environmental grounds.

Speaking of mining, as the year comes to an end, mining industries will be rounding up businesses for the year. Miners will be able to go back home to spend the festive period with their family and loved ones. This halt in gold production and the increase in the demand for Gold during the festive period will make the price of gold soar. And as inflation continues in the U.S, the price of Gold will create a new all-time high above $2075, which was created in 2020.

Technically, the price of Gold has found support above the 200 EMA on the weekly timeframe. The $1670 price level has been rejected twice, and the price is now consolidating between $1750 and $1830. Once the $1830 resistance is removed, the price of Gold is set to create a new all-time high. $2100 is the next psychological price. This will most likely occur before the end of the fourth quarter or early next year.

Leave a Reply