Fundamentals:

The U.S. unseasonably adjusted CPI for June, released last night, recorded an annual rate of 9.1%, the largest increase since November 1981 and far exceeding expectations of 8.80%. Market bets on the odds of a 100 basis point rate hike by the Fedsthis month soared to as high as 75% at one point after the data. Overall, economic activity has expanded at a moderate pace since mid-May, the Federal Reserve's Beige Book of economic conditions released overnight showed. However, several regions reported growing signs of slowing demand, with respondents in five regions saying they were concerned about the increased risk of a recession.

When asked about the possibility of a 100 basis point rate hike in July, 2024 FOMC voter and Atlanta Fed President Bostic said anything is possible. At present, swap transactions show that the possibility of the Fedsraising interest rates by 100 basis points in July has increased; the swap market shows that the probability of the Fed raising interest rates by 100 basis points in July is close to three-quarters; The odds of a 100 basis point hike are over 80%.

Technical:

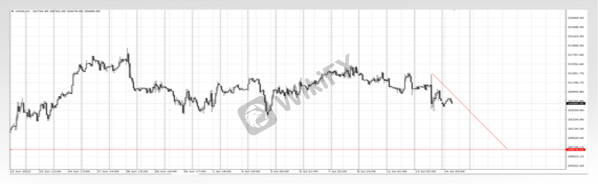

Dow:U.S. stocks were appeased by Biden, and the three major stock indexes continued to rise after opening sharply lower. The Nasdaq closed slightly down 0.15%, and fell nearly 2% during the session, the Dow fell 0.67%, and the S&P 500 closed down 0.45%. The Dow finished higher and fell back at 30700, focusing on the position near 29700 above.

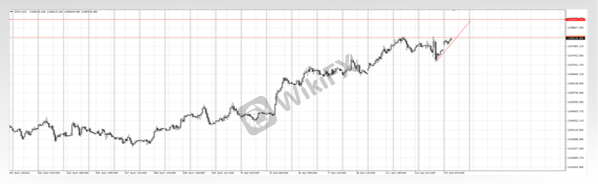

U.S. dollar: The U.S. dollar index retreated sharply after hitting an intraday high of 108.61, and gave up most of its previous gains, and finally closed down 0.111% at 108.05; the 10-year U.S. Treasury bond yield hit a high of 3.071% and then fell back to close at 2.935%. In addition, the inversion of the U.S. 2-year and 10-year Treasury yield curve expanded to 21.5 basis points, the largest since November 2000. The US dollar is cautious in chasing more historical highs, and in the short term, it is concerned about the top position near 109.

Gold: On Wednesday, spot gold saw a V-shaped rebound in the U.S. session, breaking through the $1,740 mark during the session, and rebounding by nearly $40 from the daily low. It finally closed up 0.57% at $1735.62 per ounce; the status of gold fluctuated, and the short-term target of gold was 1705.

Crude oil: In terms of crude oil, the two oil prices were on a roller coaster. WTI crude oil dived after failing to challenge $98 in intraday trading, and finally closed up 0.84% at $96.37 per barrel; Brent crude oil remained in a narrow range and closed up 0.55% at $99.61 USD/barrel. Focus on the crude oil band callback 90 position.

(The above analysis only represents the analyst's point of view, the foreign exchange market is risky, and investment should be cautious)

Leave a Reply