OctaFX is considered a higher than average risk. It is not a publicly-traded company and is not regulated by top-tier authorities. OctaFX offers a smooth registration process, quick deposit and withdrawal processes, a comfortable layout, mobile trading, Islamic accounts, attractive bonuses, and overall good user experience. However, it‘s not available for US-based users, it lacks some assets and currency pairs, and it has low trust since it’s not regulated by any top-tier authorities.

Overview

OctaFX: Pros and Cons

While OctaFX has some pretty impressive features, it also has some major disadvantages that you want to be aware of if youre considering trading with it.

| Account Opening | Not Available in the USA |

| Hedging and scalping available | Limited Instruments Available |

| All account types offer Shariah-compliant options | Not regulated by top-tier authorities |

OctaFX Compared

In order to put things into perspective and for you to understand the brokers features better, we set a brief comparison between OctaFX and its major competitors in the industry.

Account Types

OctaFX provides traders with two trading accounts: one MT4 and one MT5. Both have a maximum leverage of 1:500. The US dollar and the Euro are the account's basic currencies. The first of the two key differences between them is that MT5 traders don‘t have to pay a finance fee for leveraged trading, whereas MT4 traders do. The second difference is that MT4 doesn’t have index CFDs.

With OctaFX, users can open MT4 or MT5 demo accounts with no time limits. The MT4 demo account expires after 8 days of inactivity, while the MT5 demo account will expire after 30 days of inactivity.

The flexibility of MT4 and MT5 accounts allows traders to choose their deposit amount and leverage, resulting in more realistic demo experience. They're perfect for testing EAs and fixing bugs for algorithmic traders.

Commissions and Fees

The commissions and costs charged by OctaFX vary based on which of the 3 account types you choose (MT4 Micro, MT5 Pro, cTrader ECN.) Overall, OctaFX finds it difficult to compete with the lowest-cost MetaTrader brokers when it comes to pricing.

The MT4 Micro account has the lowest spreads, with only 39 tradable instruments, the USD/EUR spread is 0.7 pips. On the other hand, the MT5 Pro account has a collection of 45 tradable instruments with a bit higher spreads (at 1.1 pips.)

The OctaFX cTrader ECN account has a smaller product selection than its other account types, with 28 forex pairs and 2 metals available.

The MT5 Pro account is great as it has a price similar to the cTrader ECN account with almost double the tradable instruments.

Minimum Deposit

OctaFXs minimum deposit ranges from $25 when funding with Mastercard/Visa or €50 when using Neteller/Skrill, depending on the chosen payment method, to as much as 500,000 NR. Any applicable minimums are determined by your country of residence and the OctaFX entity with whom you open a trading account.

OctaFX offers more than 50 payment methods, including Visa, Fasapay, Neteller, bitcoin, and a wide range of local bank transfers. Note that some of which may not be available in your country.

Offerings

OctaFX has a limited number of tradable instruments. Many industry leaders, for example, have more than 10,000 tradable instruments.

OctaFX offers forex trading, CFD trading, 52 trading symbols, 28 forex pairs, cryptocurrency (CFD), and social trading. On the other hand, it doesnt offer cryptocurrency (physical) US stock trading (non CFD), or Int'l stock trading (non CFD).

CFDs allow you to trade cryptocurrency, but you can't trade the underlying asset directly (like buying Bitcoin). Note that crypto CFDs arent available to retail traders from any broker's UK residents, nor to UK entities.

Leverage

For Forex traders, the maximum leverage is 1:500, while for cryptocurrency traders, it is 1:25. It's ideal for scalpers and traders that need high leverages in their trading accounts.

Spreads

OctaFX has floating spreads that fluctuate with market conditions. The one good thing about a floating spread over a fixed spread is that a floating spread is smaller than average most of the time. However, it can widen at market open, during important news releases, during rollover, or during periods of extreme volatility.

Platforms and Tools

OctaFX is mainly a MetaTrader broker that offers MetaQuotes Software Corporation's range of platforms, including MT4 and MT5. There's also the cTrader, which includes the cAlgo platform.

OctaFX provides a web interface for copy trading that connects to its MT4 platform. However, OctaFX's copy trading experience lacks a sense of community, which is a feature shared by all of the most popular copy trading brokers.

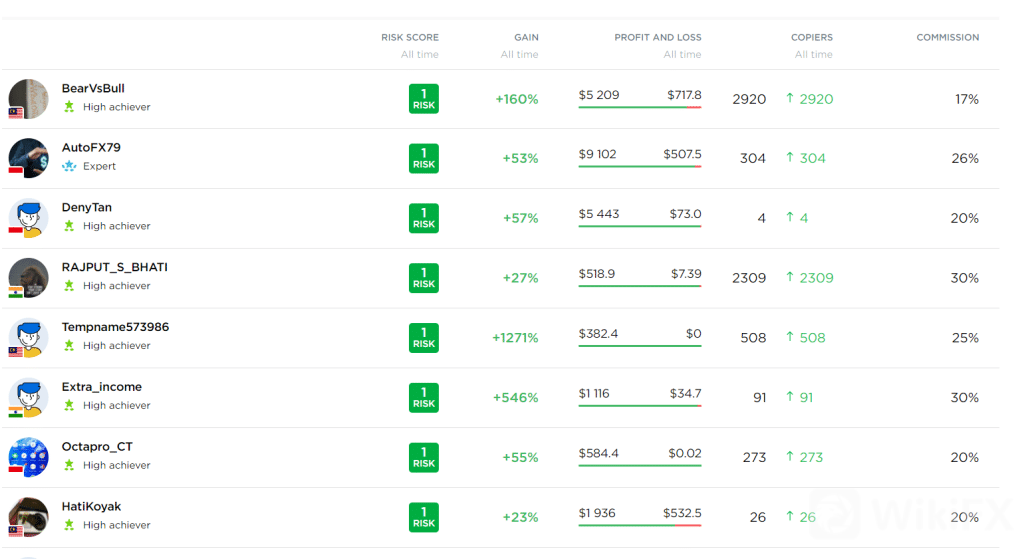

Between August and October this year, 630 of the 3340 systems featured on OctaFX's copy trading platform were profitable, accounting for around 18 percent of all strategies. All in all, the layout is good, though there can be more performance statistics included.

The MT4 and MT5 trading platforms come in three forms: a full-featured desktop client, a lightweight web trading interface for manual users, and a mobile app.

OctaFX Copy Trading

OctaFX's investment in establishing a proprietary copy trading service, which it also introduced as a mobile app, is a plus for OctaFX traders. Traders can also follow signal providers, which are called Master Traders by OctaFX.

Customer Support

If users have any problems or inquiries, the OctaFX customer support team is available 24 hours a day, Monday to Sunday. They can be contacted via live chat, phone, email, regular mail, WhatsApp, and Telegram. The FAQ section is especially useful for people who are comfortable figuring things out on their own.

The Final Verdict

OctaFX is great for investors looking for a low-cost option to get started trading a good range of assets, thanks to its narrow spreads and low opening balance requirements. While the platform is primarily focused on forex, the extra asset classes (such as UK, US, and Japanese equities) offer a good opportunity to diversify your investing portfolio.

On the other hand, if you worry about your money on OctaFX, you won‘t be happy to hear it’s only regulated by tier-2 authority which has medium trust, so if you dont mind taking the risk as 6 million traders have on OctaFX, go for it.

Leave a Reply