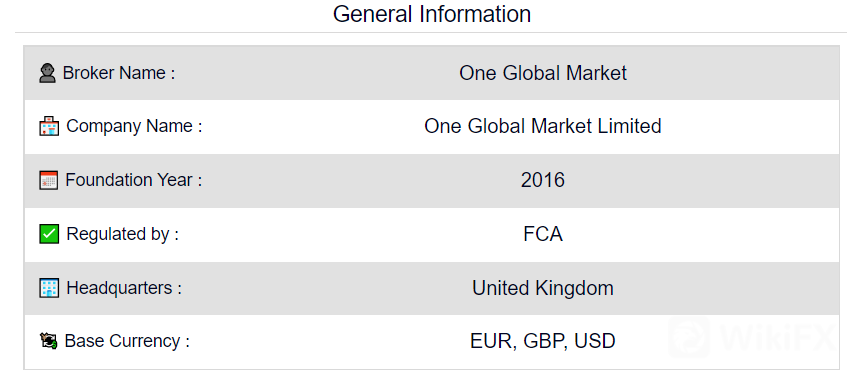

One Global Market (OGM) is a financial investment company that is regulated by the UK‘s FCA. The FCA is one of the strictest financial regulators in the world. Brokers with an FCA license have to submit frequent reports to ensure they retain their license. One of the requirements is that a broker creates a financial compensation scheme. It means that customers’ funds are very secure.

One Global Market Account Types

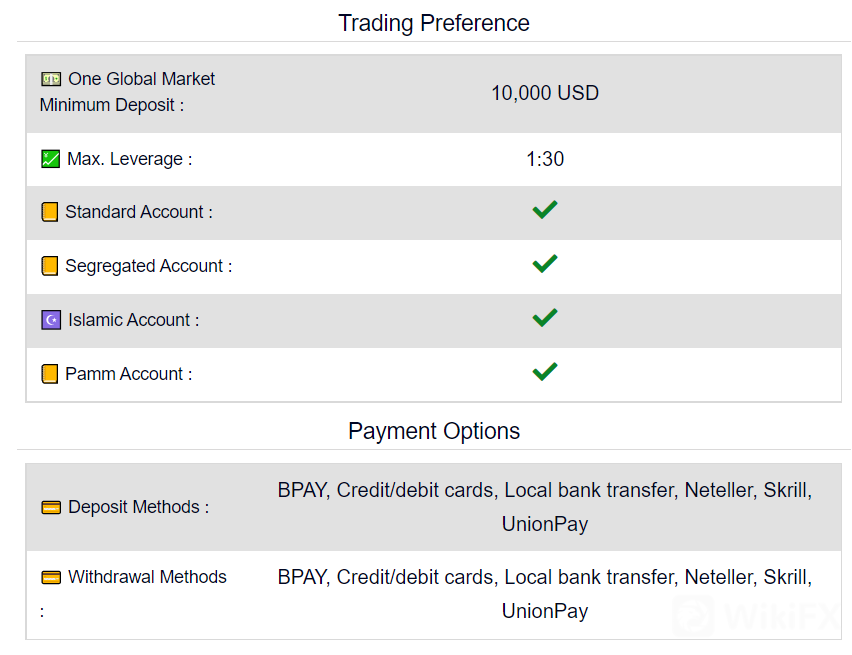

Traders using OGM have access to three account types. These are the Individual account, the Joint account, and the Corporate account. To access an account on OGM, clients have to fill out a detailed form in compliance with FCA regulations.

Customers who wish to open an individual account have to provide details such as their net worth, their liquid assets, level of education, as well as their experience level regarding futures, shares, bonds, FX, and more. OGM focused on seasoned traders who trade professionally. For new traders, OGM might not be the best platform.

Platforms

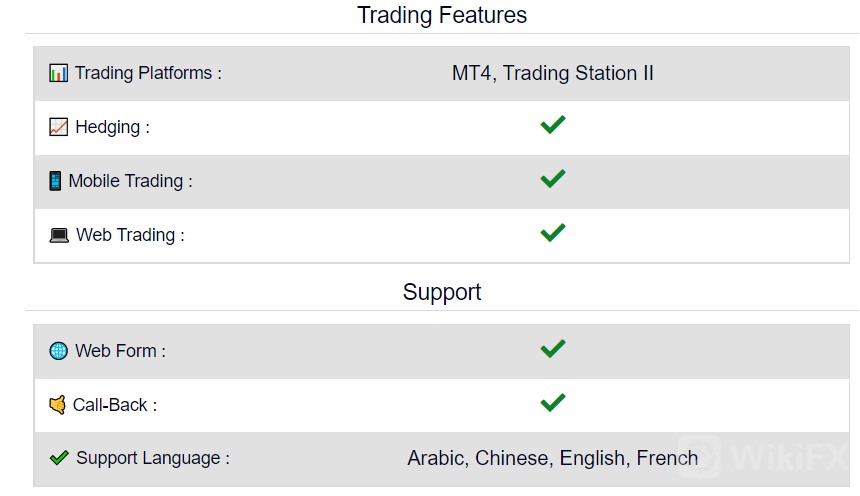

Traders using OGM will have access to the MT4 platform. The MT4 platform can be accessed on various devices including smartphones, both iOS and Android devices. Traders get access to a multilingual interface, multiple timeframes, efficient tools, full customization, and a secure and safe trading environment.

Leverage

Traders using OGM will get leverage of up to 1:30. However, it may vary depending on the specific instrument and the trader.

Trade Size Limits

OGM does not specify minimum or maximum amounts per trade.

Fee

OGM does not charge traders any additional fees or commissions for trades placed. That is especially great since OGM offers very tight spreads. There is a swap fee for overnight positions.

Assets

On OGM, traders will not access any crypto. Traders will have access to over 30 currency pairs, including some exotic pairs, precious metals such as silver and gold, indices, and various CFDs. The broker has not listed the tradable assets they offer. Customers receive the list once they open a live account.

Deposit and Withdrawals

There is no minimum deposit limit listed on the site. However, upon inquiry, OGM states that its minimum deposit is £2000 to open a live account.

The deposit and withdrawal methods supported by the broker include Visa, Mastercard, Skrill, Neteller, UnionPay, BPAy, and NetBank. OGM does not provide details on whether there are fees charged on deposits.

For withdrawals, customers can do so via a bank wire transfer or a credit card. For bank wire transfers, OGM charges a fee. The fee depends on the type of account and the location of the receiving bank.

To maintain a live account status, clients must have at least $50 in their account at all times. Withdrawals typically take two business days to complete.

Trading Tools and Education

OGM is designed for seasoned traders. However, it does still offer traders access to educational materials. The material is designed to help them make better trading decisions. Their education content includes an exclusive “Wall Street Insider Seminar.” The broker‘s team that comprises of seasoned brokers offers the seminar. It takes one day to complete the seminar. Traders get access to all of Wall Street’s secrets for successful trading. To access the seminar, traders need to fill out a form on the brokers site.

Customer Service

OGM provides a simple form is the “contact us” page for customers that want to reach out to OGM. Upon filling out the form, they will receive a call from the broker.

Summary

OGM is a great broker with a vast array of tradable assets. It is accessible on desktop and mobile devices, which allow traders to make money on the go.

Leave a Reply