【Dow Jones Index USA30】

The US Dow Jones Index fell from a high of 36963 to 35015 with a net change of about 5.4%. It officially fell below the recent upward trend line and the trend has changed from bullish to consolidation.

In terms of technical line, the current long-term, medium-term and short-term moving averages show a death crossover. The KD is also showing a low-end figure. The technical line shows that the buying power is quite weak and the key point lies in whether the support point of 34665 is blocked. If it does not, it will form an M pattern on the daily charts and this could be harder for traders to make short term trading decisions.

USA30-D1

Resistance 1: 35635 / Resistance 2: 35768 / Resistance 3: 35941

Support 1: 34659 / Support 2: 34161 / Support 3: 33800

【EURUSD】

The Fed will meet next week. Investors will be watching to see if the press conference has a closer message for a rate hike.

At present, the market expects the Fed to raise interest rates 3-4 times in 2022 and to start raising interest rates as soon as March.

A few days ago, EURUSD broke through the consolidation range, but then pulled back to return to the consolidation range. Once again, investors may switch to observer mode to see if the Fed has further information. At present, the technical line of EURUSD oscillates up and down. With the data also mixed, it is more appropriate for investors to use range trading strategies.

EURUSD-D1

Resistance 1: 1.14500 / Resistance 2: 1.14800 / Resistance 3: 1.15200

Support 1: 1.13800 / Support 2: 1.13500 / Support 3: 1.12800

【XAUUSD】

The current trend of gold is still in line with the bulls as the price of gold broke upward yesterday.

The market believes that the US economy has begun to decelerate. The main reason is that the yield of US treasuries has been rising and this indicates that the US dollar continues to be sold. The market does not trust the future prosperity of the United States and the price of gold is gradually pushed up.

Both the Alligator and KD shows a golden cross. As for the overall trend, gold is still in favour of the bulls.

XAUUSD-D1

Resistance 1: 1865.50 / Resistance 2: 1875.80

Support 1: 1832.20 / Support 2: 1814.50 / Support 3: 1789.50

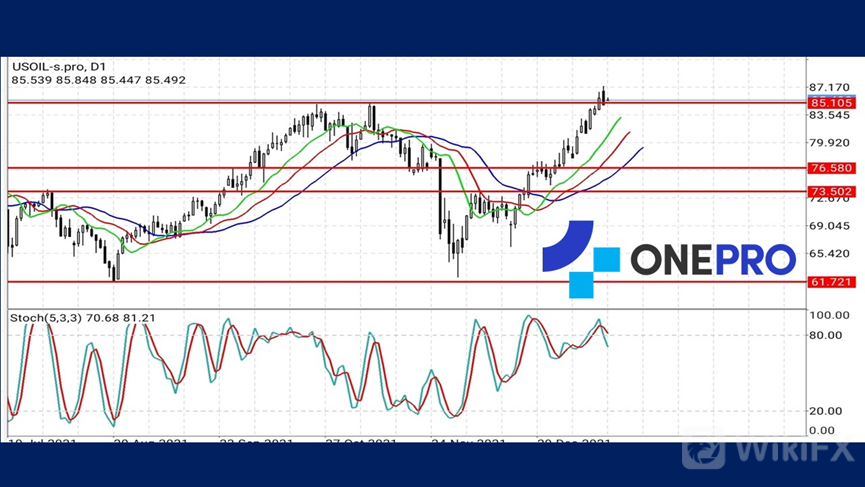

【USOIL】

The crude oil pipeline between Turkey and Iraq was interrupted because of an explosion accident on the 18th January. Although the cause of the explosion is still under investigation, this incident caused the pipeline operation to be interrupted. Once again, the market sent a tense signal for the supply of crude oil.

From the technical line, the long-term, medium-term and short-term moving average of crude oil still show a golden cross. The KD has left from the high-end area to become a death cross and this shows that the strength of the rise has weakened.

USOIL-D1

Resistance 1: 87.180 / Resistance 2: 87.800

Support 1: 85.120 / Support 2: 82.800 / Support 3: 81.820

OneProSpecial Analyst

Buy or sell or copy trade atwww.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply