S&P 500: A RECORD HIGH VERSUS A CONCERTED TREND

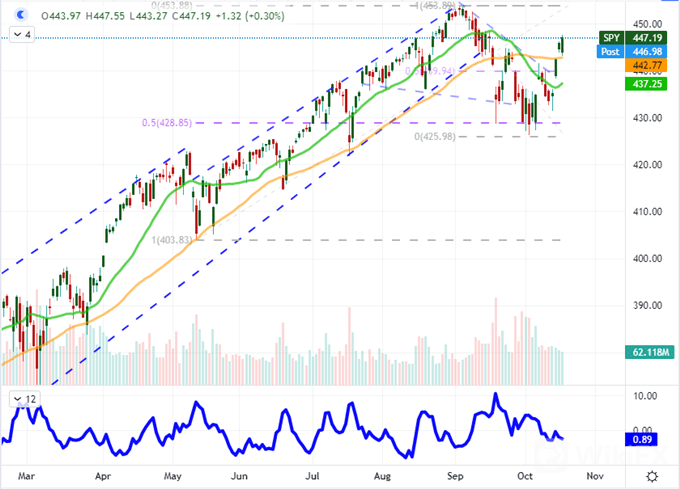

We have not kicked off the week on a particularly strong footing as far as risk assets are concerned. Monday‘s session showed a general malaise across the various speculative benchmarks that tend to track the ebb and flow of investor confidence. Considering the market’s general resilience seems to be more of an outcome ‘in spite of’ serious fundamental headwinds, the lack of commitment shouldnt come as too great a surprise. Then again, the unrelenting lift that a whole generation of trader has grown used to has clearly shaped expectations. Keeping the tempo for the instinctive lift, the US indices were in a fairly unique position of registered gains through the opening session. The S&P 500 recovered from a bearish gap to close out a fourth consecutive daily advance. We are within 1.3 percent of the record high set back in early September, which could be easy enough to reach. That said, the tempo is already struggling. We have seen much of the charge for this market come in bearish corrections or the subsequent rebound covering lost ground. When breaking new ground, the there is often little-to-no drive to be found.

Chart of SPY S&P 500 ETF with 20 and 50-Day SMAs, Volume and 2-Day ROC (Daily)

While the S&P 500 is the index I follow most closely for its ubiquity in portfolios through derivatives (SPY ETF, eminis, VIX, etc), it wasn‘t the best performance among its close peers this past session. That title goes to the Nasdaq 100. The NDX rallied 1.0 percent which adds significant contrast to the slight loss from the blue-chip Dow Jones Industrial Average. That would push the ratio of NDX-DJI abruptly higher to suggest there is a more target appetite for capital gains rather than broad investment appetite. I consider this more of a ’flash in the pan rally rather than the foundations of a lasting trend – unless an external driver adds to conviction. Another ratio of note is the S&P 500 to VEU rest of world equity ETF from Vanguard. A preference for the region not with the greatest growth potential but rather the greatest forward drift further suggests there is an opportunistic drive that could find conviction stall out sooner rather than later.

Chart of S&P 500 to VEU ‘Rest of World Equity’ ETF Ratio with 20 and 50-Day SMAs (Daily)

TWO DISTINCT FUNDAMENTAL THEMES CARRYING OUR ATTENTION FORWARD: CHINA AND THE FED

As we move into this new trading week without a distinct guide for fundamental appetite, I am keeping tabs on the matters that have the weight to take the wheel should market participants pay head. Among the opening volley of event risk this week, the Chinese data seemed to offer a balanced mix of contrition through tamed growth without adding to fears that domestic tensions risk growing out of hand. We can see that in the country‘s 3Q annualized GDP rate slowing more sharply than expected from a 7.9 percent pace to 4.9 percent (against 5.2 percent expected). Industrial production and fixed asset investment would also slow faster than projected, but domestic matters like retail sales and the jobless rate would beat their respective forecasts. For market response, the Shanghai Composite was little changed and the Yuan firmed slightly. I’m keeping close tabs on the markets perception of the situation in China with particular focus on the fringes that may show any sign of contagion such as the capital markets in trade partners.

Chart of FXI China Large Cap ETF with Volume, Overlaid with CNH/USD (Weekly)

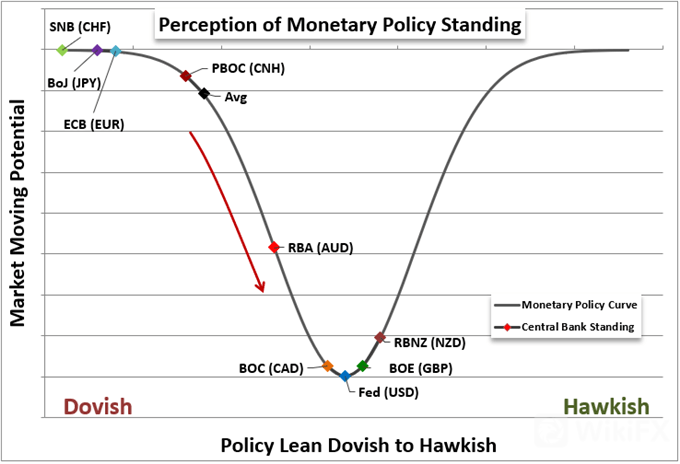

The other remarkable fundamental drive to start the week with an incredible disconnect from the market itself was the continuous drive in US interest rate forecasts. The 2022 rate forecast measured by Fed Funds futures climbed for the 11th time in the last 12 trading sessions. At Monday‘s peak, the forecast drove the anticipation for tightening all the way up to 45 basis points. Beyond a certainty of at least one standard hike in the coming year, that reflects a further 75 percent probability of a second hike. That is a meaningful deviation from the Fed’s own carefully laid outlook through a myriad of minutes, speeches and other official communiques. One side is wrong. And while the Fed has been bullied into action in the past, it seems the market may be the stretched position in this balance. That said, would a pullback from rate forecasts lead to a breakdown from the Dollar after weeks of congestion and failing to track the outlook higher? Or has the very strong positive correlation between currency and projections over the past three months simply vanished? I doubt it.

Chart of DXY Dollar Index Overlaid with Fed Forecasts 2022 and Correlation 10, 60-Day (Daily)

THEMES AND EVENT RISK TO WATCH AHEAD

Looking out over the coming 24 hours and beyond, I will be keeping tabs on rate forecasts from more than just the Federal Reserve. This past session, New Zealand consumer inflation accelerated sharply through the third quarter to 4.9 percent – pushing the chances that the RBNZ hikes rates again this year even higher. The Kiwi is tracking higher, but it is still trading at a discount to its rare hawkish position. UK and Canadian inflation is further out on Wednesday as is a Turkish Central Bank rate decision that is expected to bring a rate cut after the surprise intra-meeting cut that pushed USDTRY to record highs. I will also be watching the speculation around the Bank of England pace with central banker speak on hand.

Chart of Relative Central Bank Policy Standing

Another important event to watch for Tuesday is the start of trading for the ProShares and Invesco created bitcoin futures-based ETF hailed as another step of legitimacy for the benchmark cryptocurrency. BITO was due to start with Monday‘s US open, but the kick off was pushed back a day. Despite no hint of the SEC raising any last minute objections to derail the introduction of this new product, the underlying BTCUSD is very noticeably struggling the close the deal on a fresh record high. Perhaps the lack of broad risk appetite is curbing enthusiasm or perhaps there is a serious ’buy the rumor scenario in place.

Chart of Bitcoin with 20-Day SMA and ‘Wicks’ (Daily)

For traditional scheduled event risk over the next 24 hours, the docket is fairly light. Another debt repayment for Evergrande is likely to pass without fulfillment, but a lack of implication from local regulators and credit agencies leaves global investors in the dark as to the implications. There will also be a host of Fed speakers on tap, but their market impact has been spotty for the Dollar and US risk assets. The earnings calendar will also offer up Netflixs quarterly performance report, but this FAANG member draws a lot less attention and broader market response from the market than it once did.

Calendar of Major Event Risk for the Week Ahead

Leave a Reply