Let's discuss the theories and what is really happening.

Key Points

-

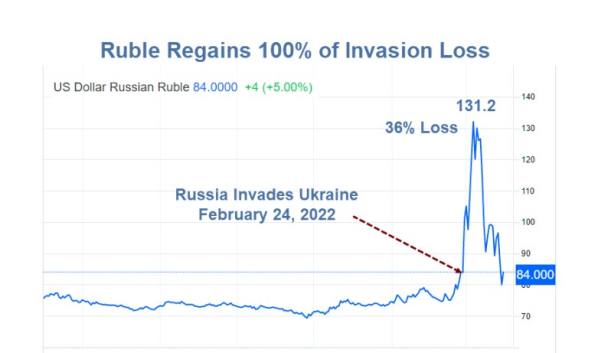

When Russia invaded Ukraine on February 24, it took 84 rubles to buy 1 US dollar.

-

On March 7, it took 131.2 rubles to buy 1 US dollar.

-

That's a 36% decline in the rubble vs the US dollar.

-

The ruble is now back where it started on February 24.

Conventional Wisdom

Putin and Italy's Prime Minister, Mario Draghi, have discussed payments for gas in Russian rubles.

Weiner correctly notes the imagination.

Oil for Rubles, Who Cares?

Case 1: To get rubles to buy oil, Europe sells Euros to Russia central bank. Europe immediately send the rubles it received straight back to Russia to pay for the the oil. Russia central bank accumulates euros.

Case 2: Russia sells oil for euros. Russia central bank accumulates the exact same number of Euros as in case number one.

The currency exchange takes place in seconds. Europe does not have to hold rubles to buy oil.

This is just more of the “oil priced in euros” stupidity. No one will have to hold rubles to buy Russian oil. Or gas. The Ruble does not become a reserve currency.

There is perhaps some small psychological impact, but there is no real impact unless Europe actually held ruble reserves, and here's a hint: Europe wouldn't.

What About European Sanctions?

Biden says “Ruble reduced to Rubble because of sanctions.”

It took another three days from that Tweet for the ruble to regain all of its losses. Why?

In three words: Sanctions Don't Work. Here are some examples.

Parallel Credit Card Payment System

The Wall Street Journal reports Russia Built Parallel Payments System That Escaped Western Sanctions

Visa and Mastercard pulled the plug on Russia's credit cards. But following the 2014 war in which Visa and Mastercard did the same, Russia took measures to not let that happen again.

Instead, Putin implemented a National Payment Card System—known by its Russian initials NSPK. Visa and Mastercard went along with it.

In 2015 Russia then forced the use of Mir cards based on NSPK.

Those cards do not use the US payment system.

One irony is that instead of Visa and Mastercard getting the fees, Russia's central bank collected 8.2 billion rubles in net profit, or about $94 million at current exchange rates.

Russia actually profited from Visa and Mastercard sanctions.

Leave a Reply