Click Here: After you read it, Daily Routine with WikiFx

#1 The Market Pays you to be Disciplined

Trading with discipline will put more money in your pocket and take less money out. The one constant truth concerning the markets is that discipline = increased profits.

#2 Be disciplined every day, in every trade, and the market will reward you. But dont claim to be disciplined if you are not 100 percent of the time.✍????

#3 Always lower your trade size when trading poorly

All good traders follow this rule.

Why continue to lose on five lots(contracts) per trade when you could save yourself a lot of money by lowering your trade size down to a one lot on your next trade?

If I have two losing trades in a row, I always lower my trade size down to a one lot. If my next two trades are profitable, then I move my trade size back up to my original lot size.

Its like a batter in baseball who has struck out his last two times at bat. The next time up he will choke up on the bat, shorten his swing and try to make contact.

Trading is the same: lower your trade size, try to make a tick or two or even scratch the trade and then raise your trade size after two consecutive winning trades.

#4 Never Turn a Winner into a Loser

We have all violated this rule.

However, it should be our goal to try harder not to violate it in the future.

What we are really talking about here is the greed factor.

The market has rewarded you by moving in the direction of your position, however,

you are not satisfied with a small winner.

Thus you hold onto the trade in the hopes of a larger gain, only to watch the market turn and move against you.

Of course, inevitably you now hesitate and the trade further deteriorates into a substantial loss.

There‘s no need to be greedy. It’s only one trade.

Youll make many more trades throughout the session and many more throughout the next trading sessions.

Opportunity exists in the market place all of the time.

Remember: No one trade should make or break your performance or the day.

Dont be greedy.

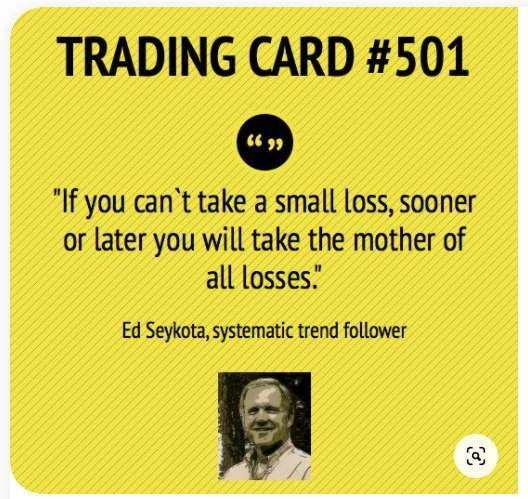

#5 Your biggest loser cant exceed your biggest winner

Keep a trade log of all your trades throughout the session.

If, for example, you know that, so far, your biggest winner on the day is five e-Mini S&P points, then do not allow a losing trade to exceed those five points.

If you do allow a loss to exceed your biggest gain then, effectively, what you have when you net out the biggest winner and biggest loss is a net loss on the two trades.

Not good.

#6..To be continue..

Leave a Reply