Fundamentals:

On Thursday, the U.S. GDP unexpectedly shrank by 1.4% in the first quarter, turning negative for the first time since mid-2020. The U.S. stock market rose collectively, the S&P 500 hit the largest in seven weeks, the NASDAQ rose more than 3%, and industrial stocks dominated the market. The index also rose nearly 2 percent. The Dow Jones Industrial Average rose 1.85% to 33,916.39. The Nasdaq Composite rose 3.06 percent to 12,871.53. The U.S. S&P 500 rose 2.47% to 4,287.50.

EU officials say it would be a violation of EU sanctions for EU companies to open ruble accounts to pay for Russian gas. Russia's request for ruble payments would be troublesome because it would involve the sanctioned central bank of Russia. Energy companies in Germany, Austria, Hungary and Slovakia, including Uniper and OMV, are preparing to open ruble accounts with Gazprom, according to the Financial Times.

Technical:

Dow: U.S. real GDP fell 1.4% quarter-on-quarter in the first quarter, lower than market expectations for a 1% increase, and far below the 6.9% increase in the fourth quarter of last year, and inflation-adjusted first-quarter GDP fell 0.4% quarter-on-quarter, the weakest quarter for the U.S. economy since the early days of the pandemic in 2020. The current Dow bears continue, continue to pay attention to the position near the bottom target of 32222 in the lower range.

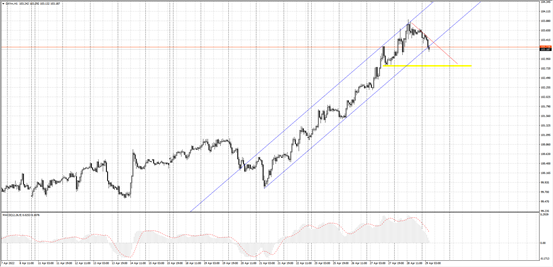

US dollar: The US dollar index rose strongly, reaching a maximum of 103.95, a new high since December 2002, and closed 0.67% at 103.67; the 10-year US bond yield rose slightly to 2.83%. The U.S. dollar index kept hitting new highs, and the U.S. dollar continued to rise at the high opening, reaching the former high-pressure position near 103. At present, it is necessary to be cautious in chasing more U.S. dollars.

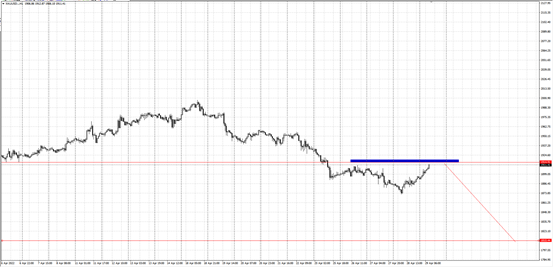

Gold: It stopped falling and rebounded on Thursday, and the intraday low fell to $1,872/oz. The European market began to fluctuate higher and closed 0.48% at $1,894.72/oz. Spot silver fluctuated down and closed 0.55% at $23.16/oz. At present, gold has retreated slightly to the vicinity of 1915 above the short-term range and pay attention to the pressure level above the range of 1915. If the pressure position is valid, we will continue to pay attention to the gold shorts.

Crude oil: Crude oil continued to rise, WTI crude oil closed 3.21% at $105.7 per barrel; Brent crude oil closed 2.2% at $108.23 per barrel. Crude oil prices pulled back, pay attention to the target near the first pressure position above 105, and pay attention to the 92 positions at the bottom of the short continuation range in the later period.

(The above analysis only represents the analyst's point of view, the forex market is risky, and investment should be cautious)

Leave a Reply