Every trader who wishes to remain profitable in the market must pay greatest attention to the market trend. The market trend shows the direction the market is headed to over a period of time. Trends are best calculated using at least one month time frame which is 30days.

Trend in Forex means the direction of the market over a given period of time. Generally speaking Market Trend in Forex suggests the dominant position the market is headed to based on supporting technical and Fundamental Analysis. Trend informs the trader on the best position to take in the market – whether to go Long or Short the market. The market trend therefore is the best friend of the trader who informs him on which position to take in the market as to make profits. Trends are best determined using the monthly intervals. Other time frames as weekly, Daily, Quarterly etc could be misleading in calculating the trend. The later is only suitable for scalping and daily traders. Data gotten from the monthly trend are therefore expected to guide the daily and swing traders in taking their positions.

Types of Trend

Basically there are two types of Trend in the market known as the UPWARD and DOWNWARD trend.

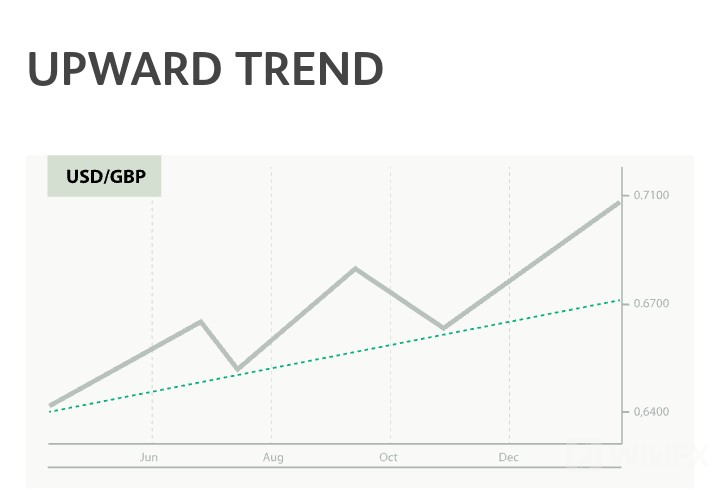

A. UPWARD TREND:

This is when there is a general increase in the market prices for the different pairs. During the upward trend we say the market is en route to price discoveries and hence creating new ALL-TIME-HIGH. Another way to describe the upward trend is to equate it with the BULL SEASON. During this season we predict strong higher movement for the different pairs based on available technical and Fundamental support. This is for the trader the best buying time. It is the time to go LONG.

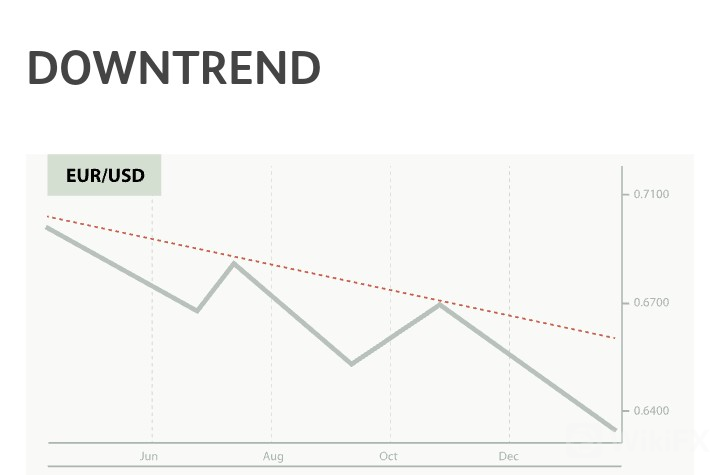

B. DOWNWARD TREND:

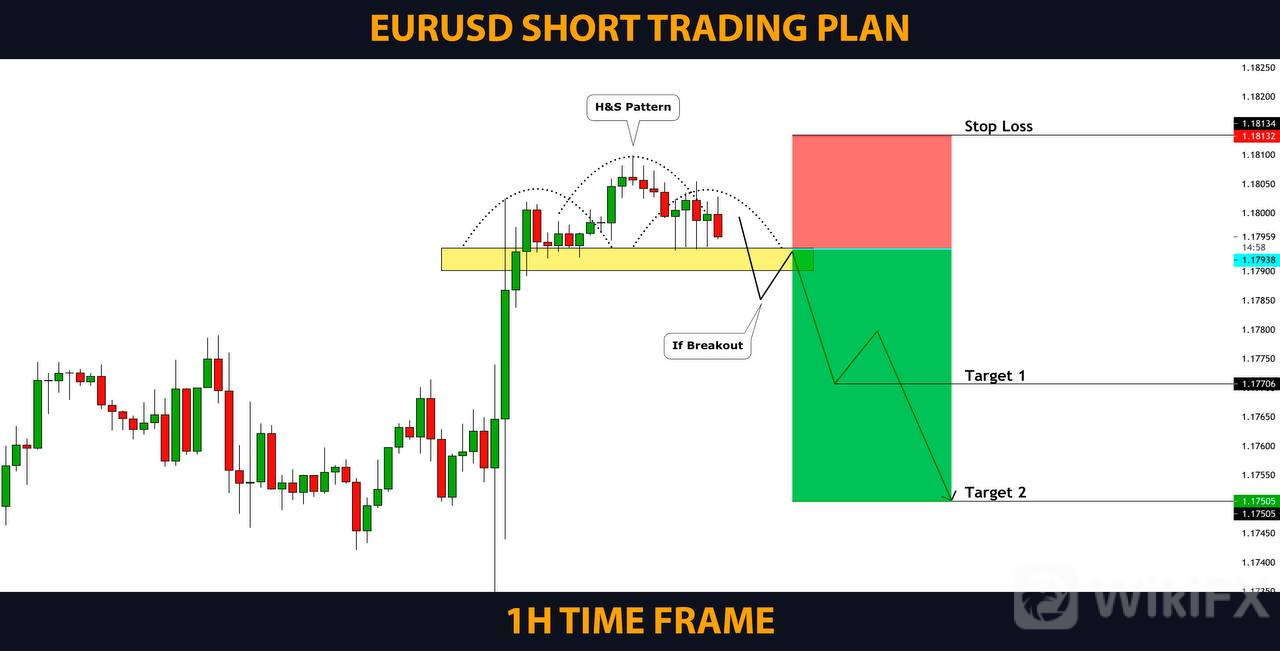

This is when there is a general fall in the market prices of a given pair. Here investors are said to be taking profits from their long positions leading to sharp decline in the market prices. At this point new type of traders know known as the bears dominate the market and keep shorting it. The downward trend is the time when the market creates new ALL-TIME-LOW. Here we see red candles everywhere showing the market prices is constantly loosing value and depreciating.

TREND LENGTH

The duration of a market trend is known as trend length. Here we simply ask the question: How long will the present UPWARD/DOWNWARD TREND LAST? When will the next trend begin? To answer this question we shall identify immediately three types of Trend length below:

A. PROLONGED TREND (LONG TERM):

This is the type of trend that lasts for a very long time say 2-3 months interval or more. It is a very domineering trend. This trend gives the trader a very huge profit in the long term.

B. INTERMEDIATE TREND:

This type of trend does not last more than a month. Often it lasts for only 2-4 weeks. It could be termed monthly trend.

C. Daily/Short Term Trend:

This type of trend as the name suggests lasts only for a day. It is very useful for daily traders.

Leave a Reply