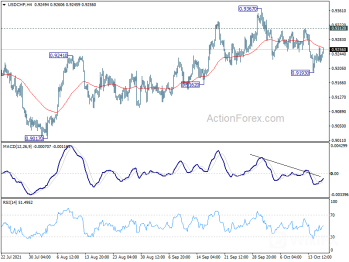

October has been a drowning moment for the US dollar as the market performance of the Greenback across the entire major pairs seems to have suffered a negative notion. A recap to the last day of the previous trading session, the US dollar had a risk-off period during the early hours of the Asian trading bout on Friday. The appearance of this action fostered a huge bullish impact on the safe-haven currency (Dollar) causing the greenback to encounter a moderate strength against the EUR, GBP, AUD, NZD pairs. Only to experience the same bullish action for USD/CHF and USD/JPY, however, the price action of the CHF, and JPY seems to not correlate with the standard, in which the US dollar was operating on Friday.

But before the arrival of the risk-off market condition on Friday the pair had an irregular trading bias, which caused the Swiss franc to not respond to the not so bad fundamental economic updates that were coming from the US region. In addition, the expectation for a higher US Treasury earnings report on Friday also failed to boost the demand for the US dollar. Hence further losses in the value of the greenback were recorded all through the end of the last trading week. While the preceding trading bout marked the third downward trading period printed on the USD/CHF chart yet the market is expected to face a more bearish moment In the coming weeks ahead.

Commerzbank Comment On The USD/CHF

A report from the Team Head of FICC technical analysis research Centre at Commerzbank, instructs that the SWISSIE is liable to dip below the current agreed support level at 0.9124s to the market value of 0.9081 in the next trading session ahead. Although many market participants believe that the forthcoming November federal reserve chairman Jeremy Powell speech concerning rates hikes and bond purchases temporary termination roundup news has been the major factor behind the fear sentiment the US dollar has been going through since the inception of October. However, the alarming issues around inflation and the supply chain tie-ups are also part of the negative force behind the bearish price action of the dollar. On the flip side, the USD/CHF pair has been trending back down on a continuous three week low, however, it'd be best to predict that the haven currency pair most recent bearish price action is most likely to reign all through to the end of October as market value eyes the initial support zone on the daily price chart at 0.91249.

4th Week Of October Major Economic Reports For The Dollar

The last week of October will be faced with a huge financial announcement coming predominantly from the US monetary system. In the wake of the imminent trading week, market players should be on the outlook for the following economic updates that are examined to be released during the next trading session.

- Monday holds 3 months and 6 months bill auctions, however, the magnitude of this announcement is considered to be less important on the overall market sentiment of the dollar on Monday.

- On Tuesday, the US house price index and consumer confidence are one top focus economic updates that'll be released by Tuesday.

- Wednesday also has the US core durable goods order to be reported.

- Thursday holds the announcement for the US GDP (QoQ) for quarter 3 also pending home sales will be the next major economy that should be given high trading consideration.

To prevent yourself from suspicious brokers I choose WikiFx to research brokers: https://jump.wikifx.cc/gip?gip=A355361E6F13F706

Leave a Reply