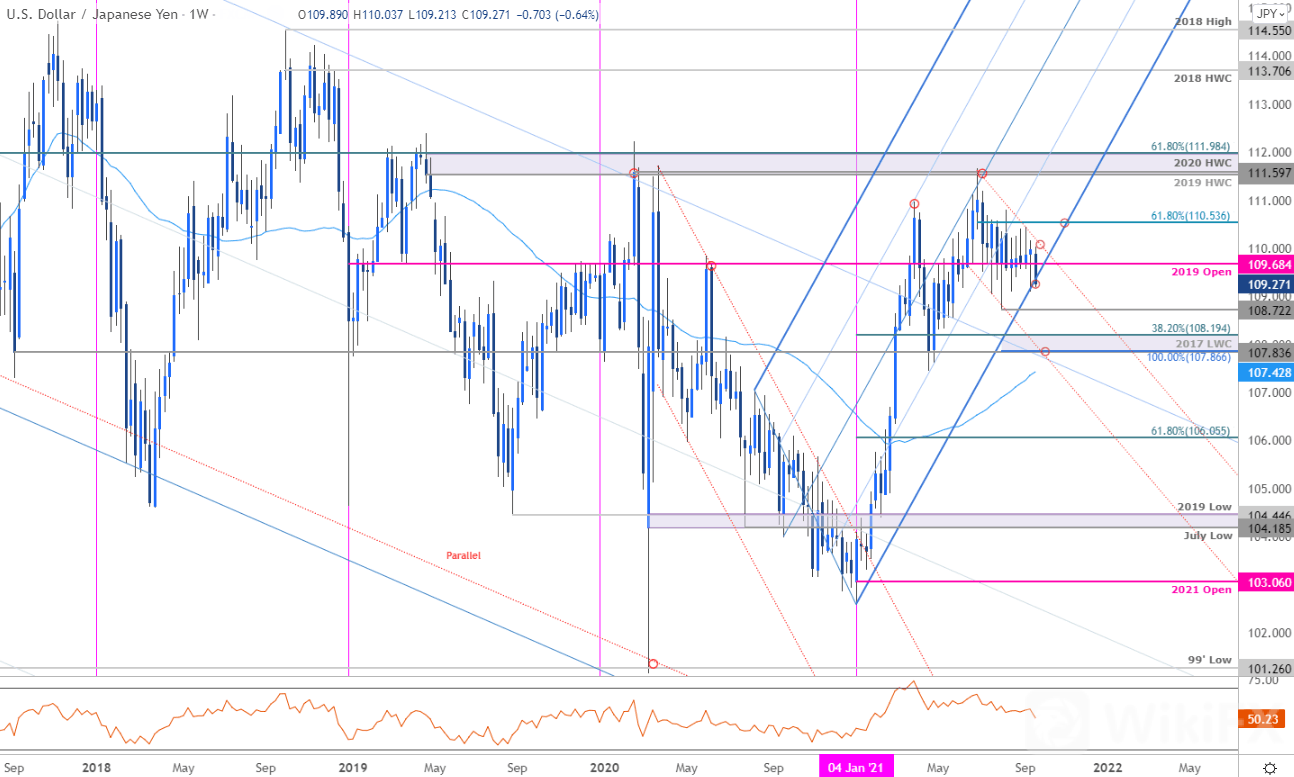

The Japanese Yen rallied more than 0.6% against the US Dollar since the start of the week with USD/JPY plummeting into the range lows at multi-month uptrend support – the battle lines are drawn. These are the updated targets and invalidation levels that matter on the USD/JPY weekly price chart heading into tomorrows highly anticipated FOMC rate decision.

USD/JPY is at uptrend support here (near ~109.07) just ahead of the Fed and the focus is on the weekly close with respect to this trendline. Advances should be capped by channel resistance (currently near ~110) IF price is indeed heading lower with a break exposing the August lows at 108.72 and critical support at 107.86-108.19- a region defined by the 2017 low-week close, the 100% extension and the 38.2% Fibonacci retracement of the yearly range. Ultimately a breach / close above the 61.8% retracement at 110.53 would be needed to mark resumption of the broader uptrend towards 111.60s again.

USD/JPY is now testing the lower bounds of a multi-week price range and were looking for a breakout in the days ahead to offer guidance. From at trading standpoint, a good zone to reduce short-exposure / lower protective stops – look for a reaction / price inflection the yearly upslope with a close below threatening a larger correction towards 108. Stay tuned for the next 24 hours with central bank rate decisions from the Bank of Japan (BoJ) and the Federal Reserve on tap.

Leave a Reply