Trading foreign exchange (Forex) online involves a currency pair. The huge number of accessible currency pairs is split into three categories: major, minor, and exotic pairs.

The 'big four'—most traded—pairs are widely considered to be EUR/USD (Euro/US Dolla), GBP/USD (British pound/US Dollar), USD/JPY (US Dollar/Japanese Yen), and USD/CHF (US Dollar/Swiss Franc). The other highly traded pairs are USD/CAD, (US Dollar/Canadian Dollar) AUD/USD, (Australian Dollar/US Dollar) and NZD/USD (New Zealand Dollar/US Dollar).

Any two major currency pairings that do not have the USD in them are considered minor currency pairs (also known as cross-currency pairs), for example, EUR/GBP, EUR/JPY, GBP/JPY, GBP/CAD, CHF/JPY, EUR/AUD, and NZD/JPY.

What are exotic currency pairs

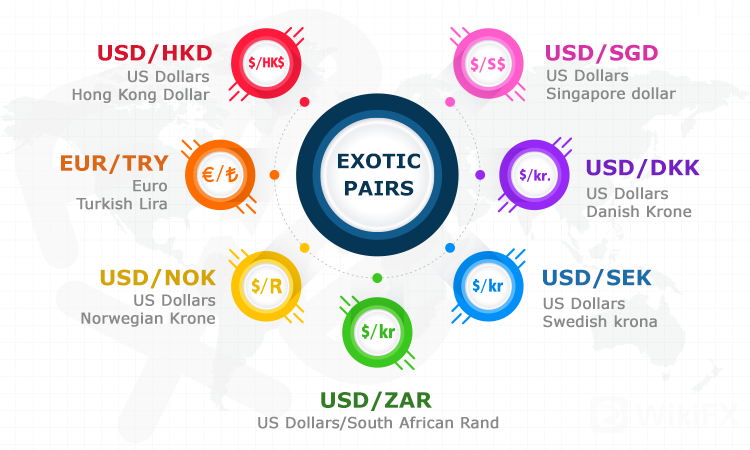

An exotic currency pair includes one major currency alongside a currency from an emerging or developing economy. The pairing of, for example, the Indian rupee (INR) with the Japanese Yen (JPY) would be an exotic pair. The most common exotic pairs include:

· British Pound and South African Rand (GBP/ZAR)

· US Dollar and Hong Kong Dollar (USD/HKD)

· Japanese Yen and Norwegian Krone (JPY/NOK)

· Euro and Turkish Lira (EUR/TRY)

· New Zealand Dollar and Singapore Dollar (NZD/SGD)

· Australian Dollar and Mexican Peso (AUD/MXN)

Features of exotic pairs

Low liquidity: Most Forex traders deal in major currencies. As a result, few traders trade exotic currencies. It has made exotic currency combinations to be the least liquid and hence highly avoided. Thus, they have a substantially lower volume than the major and minor currency pairs.

The Eco-political Connection: Exotic currency pairs are inextricably affected by the GDP and political developments of the third world countries they represent. Any changes in the political and economic environment in these nations substantially impact their currency's performance in the Forex market.

Highly volatile: Low volume (or low liquidity) and unstable political and economic conditions in developing countries make exotic currency pairs more volatile.

Unusual and Uncertainty: Exotic currency trading is not available in most ordinary brokerage accounts. There is also a scarcity of available information regarding the dynamics that drive these pairs, including their potential return possibilities.

Why trade exotics?

Why would you want to trade unusual pairs? It's straightforward. Exotic pairs are profitable due to their extreme volatility. When a trader chooses to trade exotics, it almost typically means that the pair involves the currency where the person lives. They thus want to take advantage of the “insider economic and political news” that comes “first hand” to the locals.

Why avoid exotics?

Bid-Ask Spread is Wide: The main drawback of exotic pairs is that the difference between the ask and the bid price can be extremely wide.

High volatility and low liquidity: The price will abruptly shift direction, rising or falling sharply, and producing gaps. This complicates the trading process significantly. Low liquidity also raises the range of potential slippages.

Tricky fundamental analysis. For major currency pairs, you can use a simple economic calendar to track major global news. However, for most exotics, you will have to carefully monitor the array of news for a particular country, making the analysis more complicated and time-consuming.

Costly Transactions: The cost of completing exotic pair trades is high due to their low liquidity and high risk.

Forex trading is the most profitable business to start because it involves very little capital and training. However, the trading sector is rife with con artists, and WikiFX is here to help. WikiFX is a third-party site that helps forex traders to check if a broker is official, legal, and legitimate. It is dedicated to assisting users in spotting fraudulent brokers so that traders do not fall victim to their schemes.

Leave a Reply