【Dow Jones】

Manufacturing activity of the New York State in May fell sharply for the third time this year with new orders and shipments plummeting. However, manufacturers are slightly optimistic about business conditions over the next six months.

In addition to these growth concerns, the New York City's COVID-19 alert level may be adjusted to a high level and the mandatory wearing of masks in public places may be considered.

Dow Jones index rebounded from the bottom and the current stage of the KD indicator rose rapidly forming a golden cross. The long-term Alligator shows a death cross which indicates that this wave of rise is only a rebound and not a trend reversal. This is because the price is located near the previous wave low and the current position is at the junction of bulls and bears. Near this price level, there is bound to be a wave of fierce battle between long and short.

USA30-D1

Resistance point 1: 32800 / Resistance point 2: 33500 / Resistance point 3: 34200

Support point 1: 31800 / support point 2: 30800 / support point 3: 30200

【Gold】

The rising yields of the US dollar and government bonds have been the victims of gold's unfailing nature and this made gold less attractive.

However, weak economic data from the United States, China and the European Union still provide a safe-haven support for the market.

The New York Fed said Monday that the manufacturing index plunged 36.2 points to minus 11.6 in May which is a decline to 16.5 and worse than market expectations.

China's retail sales fell 11.1% year-on-year in April which is also worse than the market expected of 6.6% year-on-year.

The eurozone's growth forecast for 2022 was also revised from 4% to 2.7%. This has increased the demand for gold.

After falling for several days, the gold index was finally supported by unfavourable economic factors in many countries. The rebound market was only limited and that allowed the KD indicator to temporarily get rid of the low-end figure at the bottom. There is currently a defence war at $1800 per ounce. The follow-up observation should be whether this key price can be held.

XAUUSD-D1

Resistance point 1: 1830.00 / Resistance point 2: 1850.00 / Resistance point 3: 1870.00

Support 1: 1810.00 / Support 2: 1800.00 / Support 3: 1790.00

【Crude Oil】

Saudi crude oil exports fell to 7.235 million bpd in March.

Crude oil exports in March fell about 1 percent from 7.307 million bpd in February. Meanwhile, Saudi crude oil production rose to a high of about two years in march at 10.3 million barrels per day, as compared with 10.225 million barrels last month.

Saudi Arabia's finance ministry said oil revenues surged 58 percent as oil prices soared. The country reported a budget surplus of $15.33 billion in the first three months of 2022.

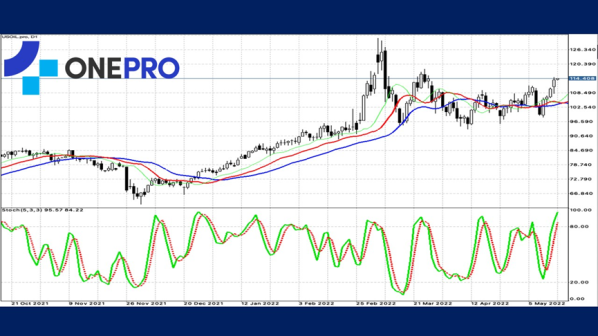

Crude oil prices have recently risen strongly after breaking through the previous high. The current Alligator has begun to move towards a golden cross while the KD shows a high-end figure. This indicates that the strength of the bulls is strong and if this price movement breaks through again, it may be possible to challenge the historical price high.

USOIL-D1

Resistance point 1: 116.800 / Resistance point 2: 118.500 / Resistance point 3: 120.200

Support point 1: 112.500 / support point 2: 110.200 / support point 3: 108.800

【Bitcoin】

Bitcoin has been out of sorts recently. The market value of the $100 million bitcoin held by El Salvador has fallen by 1/3, and the plan to issue $1 billion of bitcoin bonds has also been put on the shelf.

Experts warn that bitcoin's plunge hit The Sardistan's finances and jeopardized its ability to repay its debts. El Salvadoran President Nayib Bukele is optimistic about the future of bitcoin, and in September 2021, it announced that it would be listed as legal tender. This could set a global precedent and spending huge sums of money to buy bitcoin.

Bitcoin has fallen all the way since hitting an all-time high of nearly $69,000 in November 2021.

Bitcoin's price has not performed well recently and has fallen below 30,000 per piece. The long-term Alligator has been showing a death cross for a period of time. With the opening quite large, it indicates that the bearish pattern strength is still quite strong. The price movement of many other virtual currencies have also been relatively weak.

BTCUSD-D1

Resistance point 1: 30500 / Resistance point 2: 31500 / Resistance point 3: 32800

Support point 1: 29000 / support point 2: 27800 / support point 3: 26200

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs at www.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply