The single currency regains the upside and pushes EUR/USD to fresh 2-week tops in the 1.1365/70 band on turnaround Tuesday.

EUR/USD looks to data, risk appetite

EUR/USD quickly fades Mondays pullback and resumes the upside further north of 1.1300 the figure in the first half of the week.

Diminishing US yields amidst rising risk-off sentiment continue to undermine the risk complex and keep the greenback under downside pressure for the time being, always in a context dominated by the discovery of a new COVID variant named omicron and rising uncertainty on the potential impact on the global economy.

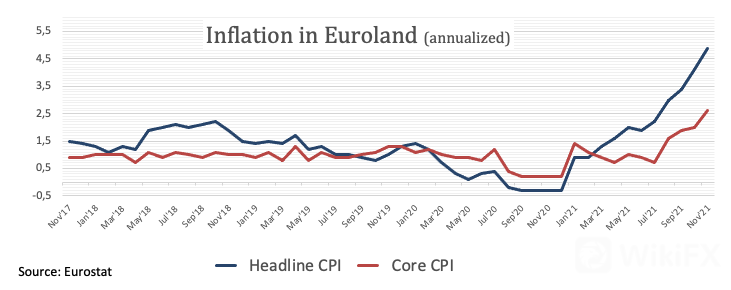

In the domestic docket, preliminary inflation figures in the broader Euroland expect the headline CPI to rise 4.9% YoY and 2.6% when it comes to the Core CPI in November. Earlier in the session, the German Unemployment Change dropped by 34K persons, and the Unemployment Rate ticked lower to 5.3% also for the current month.

Across the pond, the testimony by Chief Powell will take centre stage followed by Novembers Consumer Confidence gauged by the Conference Board.

What to look for around EUR

EUR/USD advances well past the key 1.1300 hurdle to new tops amidst renewed dollar weakness. The corrective downside in the greenback propped up the move higher in spot, although this is regarded as temporary. Fresh coronavirus concerns sparked after the new variant omicron was discovered last week is likely to keep the demand for the safe haven on the raise at least in the very near term. In the meantime, the outlook for the European currency remains well into the bearish territory on the back of the ECB-Fed policy divergence, increasing COVID-19 cases in Europe as well as some loss of momentum in the economic recovery in the euro area, as per some weakness observed in key fundamentals.

Key events in the euro area this week: German labour market report, EMU Flash CPI (Tuesday) – German Retail Sales, EMU/Germany Final Manufacturing PMIs (Wednesday) – EMU Unemployment Rate (Thursday) – EMU/Germany Final Services PMIs, ECBs Lagarde (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the region. Increasing likelihood that elevated inflation could last longer. Pick-up in the political effervescence around the EU Recovery Fund in light of the rising conflict between the EU, Poland and Hungary on the rule of law. ECB tapering speculations.

EUR/USD levels to watch

So far, spot is gaining 0.65% at 1.1364 and faces the next up barrier at 1.1374 (high November 18) followed by 1.1389 (20-day SMA) and finally 1.1464 (weekly high Nov.15). On the other hand, a break below 1.1186 (2021 low Nov.24) would target 1.1185 (monthly low Jul.1 2020) en route to 1.1168 (low Jun.19 2020).

Leave a Reply